Create Stable Pools on Raydium

Introduction: Why Choose Raydium?

In the Solana ecosystem, decentralized exchanges (DEXs) and liquidity mining platforms are constantly emerging—from Orca and Raydium to various new Pump.fun-style projects—giving users a wide range of choices. However, Raydium remains one of the most reliable and liquid DeFi protocols on Solana, especially suited for long-term liquidity providers (LPs) and traders.

- Raydium is a well-established DEX in the Solana ecosystem, utilizing a CLMM (Concentrated Liquidity Market Maker) + order book hybrid model, deeply integrated with Serum for a more efficient trading experience.

- Raydium's liquidity pools share depth with Serum's order book, reducing slippage and making it ideal for large trades.

- It offers dual-token (LP token) farming, with rewards coming from real trading fees rather than inflationary token incentives.

Creating a CLMM Pool

After creating your token using CPBOX's SOL one-click token creation, go to the Raydium official website and connect your wallet.

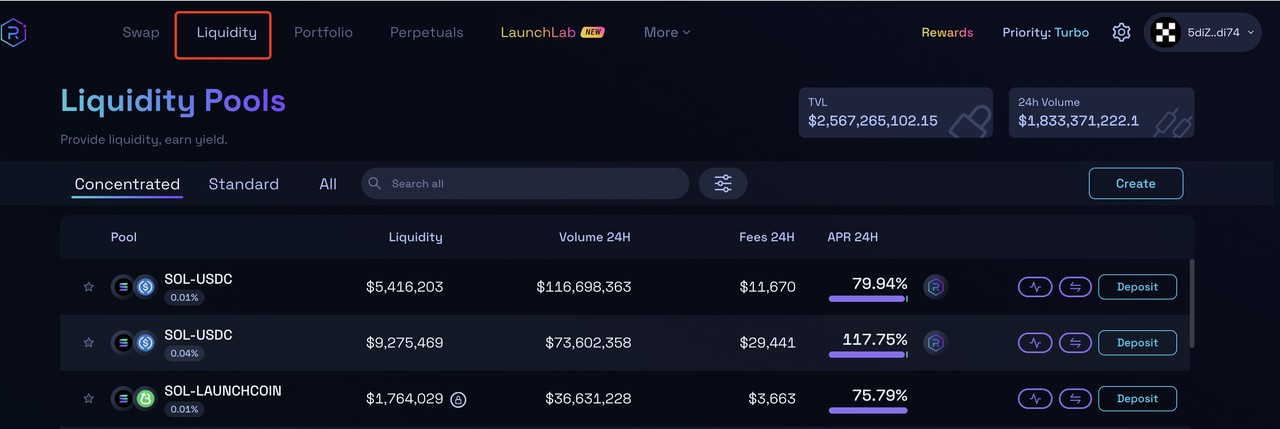

Click "Liquidity" in the top-left corner of the page.

On the new page, click the "Create" button on the right.

.png)

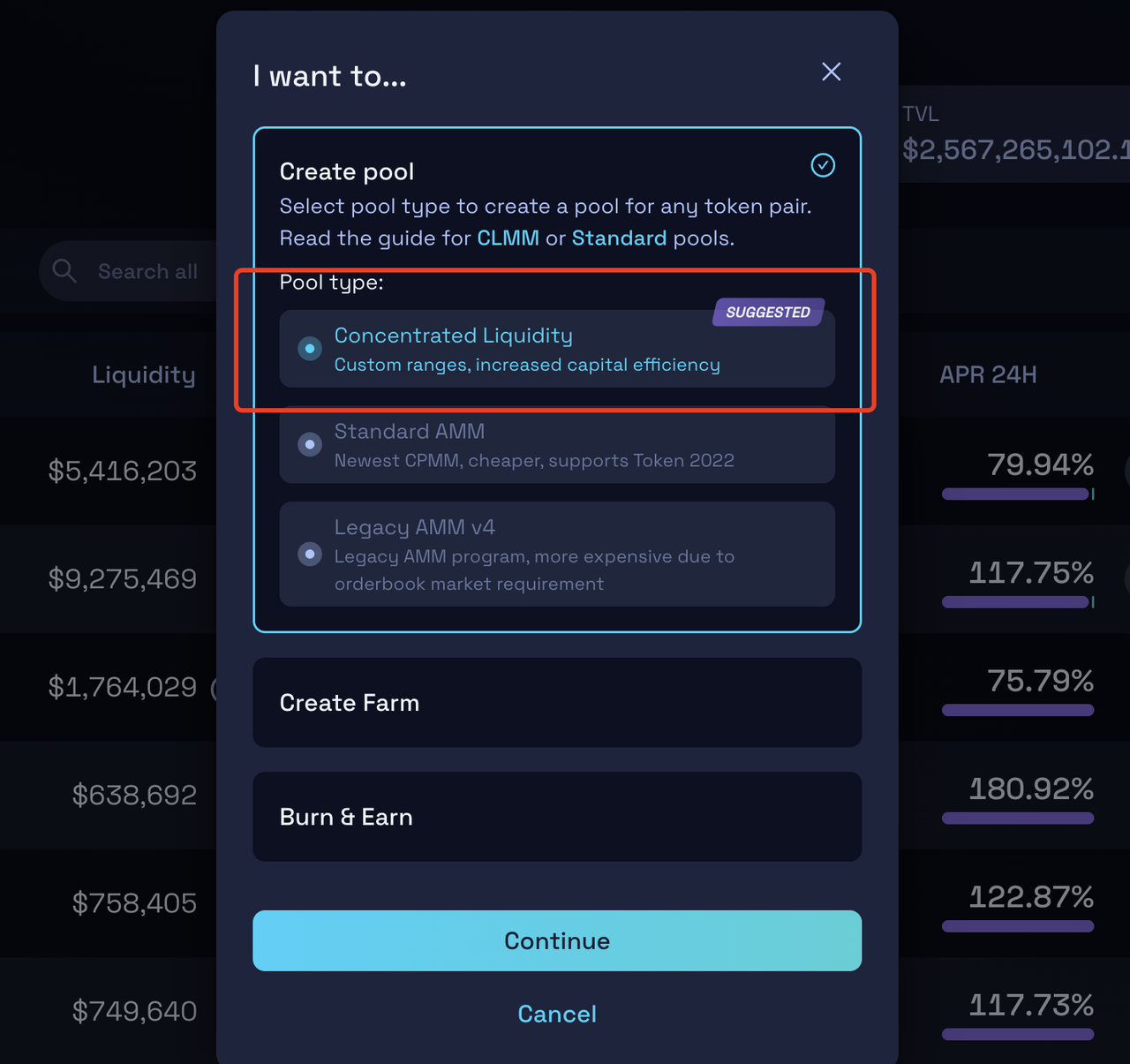

A pop-up will appear—under "Pool Type", keep the default selection ("Concentrated Liquidity") and click "Continue."

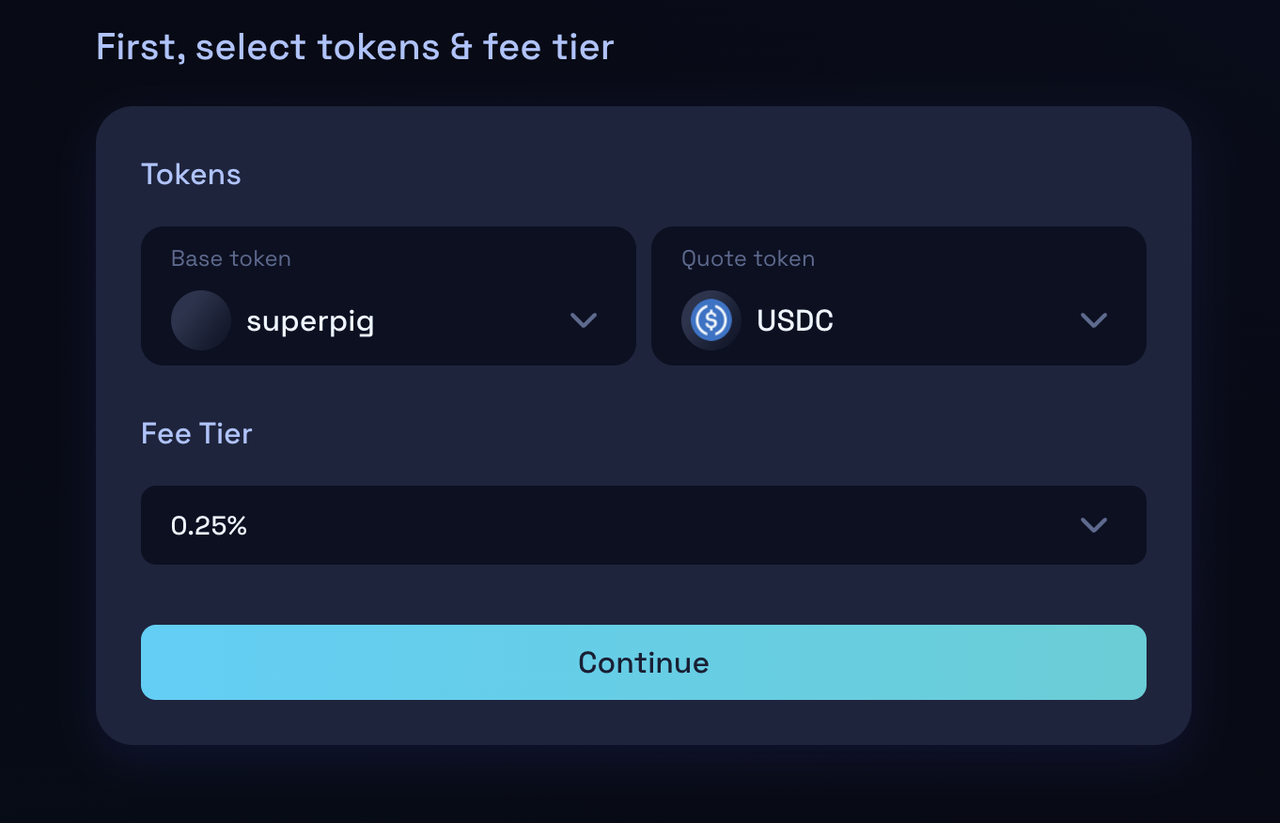

Selecting Base & Quote Tokens

- The base token is the first token in the trading pair, while the quote token represents the amount needed to buy 1 unit of the base token.

- To enable trading for your token, select your newly created token as the base token.

- Common quote tokens include SOL, USDC, or other stablecoins.

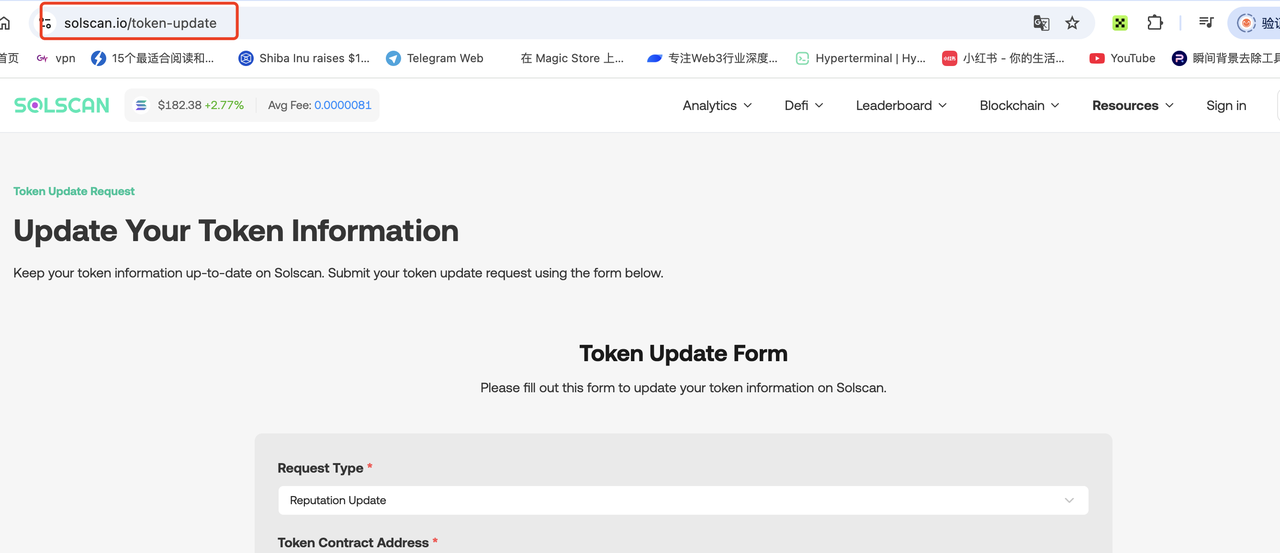

⚠️ Note: If your token doesn't display an icon or details, it likely hasn't been verified on Solscan. To fix this, update the token's metadata and complete the verification process.

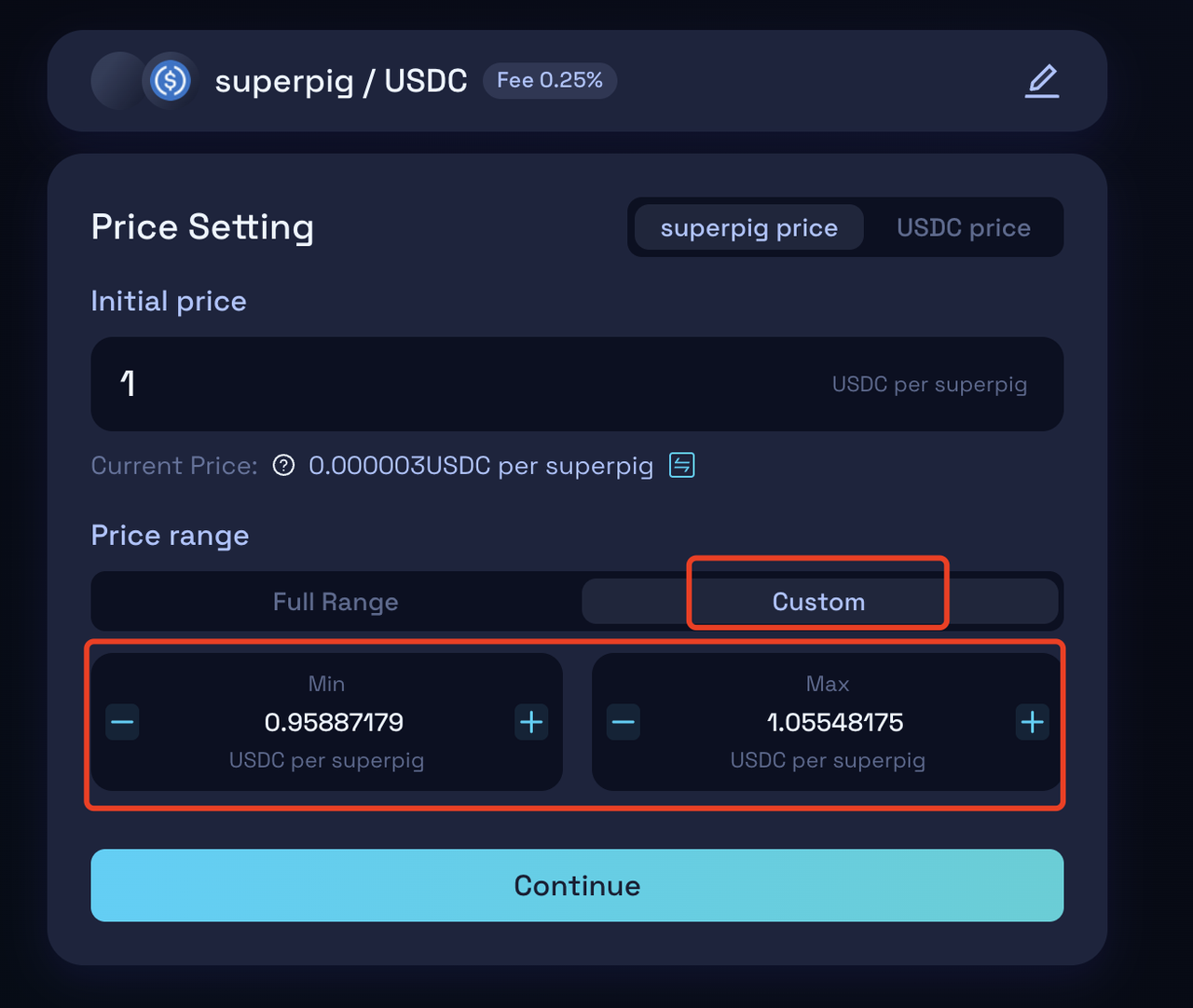

Click "Next" to proceed to the price range setting.

- Here, you'll define the price range for liquidity concentration.

- For example, if you want your token to stabilize around $1, set a narrow price range.

- If liquidity depth is insufficient, trades may fail to execute.

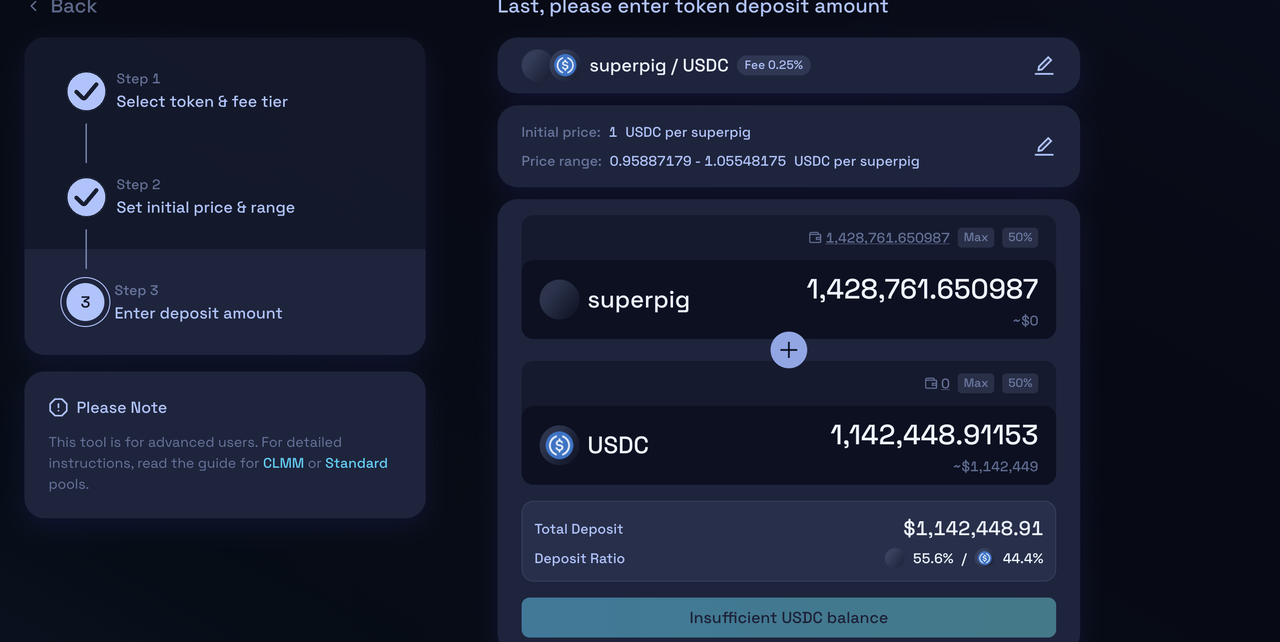

Click "Next" to reach the final confirmation screen.

- Enter the initial amount of tokens you want to deposit into the liquidity pool.

- (In this demo, we can't proceed due to insufficient USDC balance.)

Once confirmed, your pool will be successfully created.

Adding Liquidity (Depositing into a Pool)

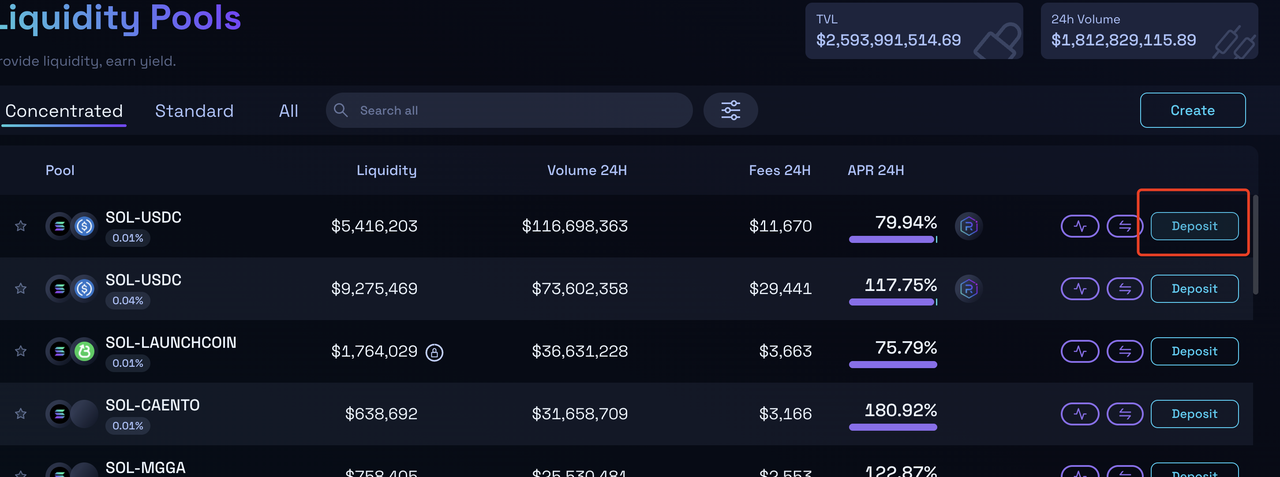

Return to the Liquidity homepage.

To demonstrate, we'll select an existing pool—if you've successfully created your pool, you can search for it directly.

Click "Deposit" to enter the liquidity management interface.

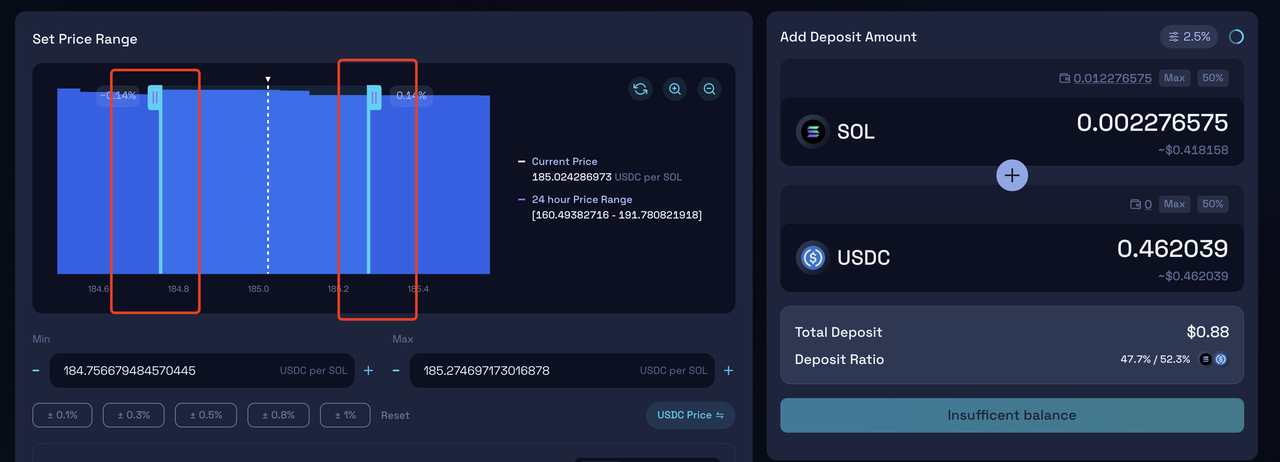

- Since this is a Concentrated Liquidity pool, you can provide liquidity within specific price ranges.

- This allows LPs to minimize impermanent loss by focusing liquidity where it's most effective—a key advantage of CLMM.

That's it for the Raydium liquidity pool tutorial!

Learn More About CPBOX

Explore features: https://docs.cpbox.io

Suggestions or custom needs?

Contact us:https://www.cpbox.io/

Join Our Community

Telegram Group: https://t.me/cpboxio

Twitter: https://twitter.com/Web3CryptoBox | https://x.com/cpboxio

YouTube: https://youtube.com/channel/UCDcg1zMH4CHTfuwUpGSU-wA