Add Liquidity to Pools

Why Your Token Needs Liquidity

After creating a token on Sui, you can't trade it immediately—unlike platforms like Pump.fun that offer built-in trading. On Sui, you must manually create a liquidity pool on a DEX. Here are the top Sui DEX options:

- Cetus: The largest decentralized exchange (DEX) on Sui.

- Turbos: A zero-slippage perpetual and spot trading platform.

- BlueMove: Supports both NFT and token trading (Aptos/Sui).

This guide focuses on Cetus, the most widely used DEX.

Why Add Liquidity?

- Enable Trading: Without a pool, your token is just blockchain data—no one can buy or sell it.

- Stabilize Prices: Automated Market Maker (AMM) algorithms (e.g.,

x*y=k) balance price fluctuations. Larger pools = less price impact per trade.

Who Provides Liquidity?

- Projects: Inject initial funds (e.g., 10K SUI + 10M tokens) to bootstrap trading.

- Users: Earn 0.3% fee shares by staking in pools.

Step-by-Step: Creating a Pool on Cetus

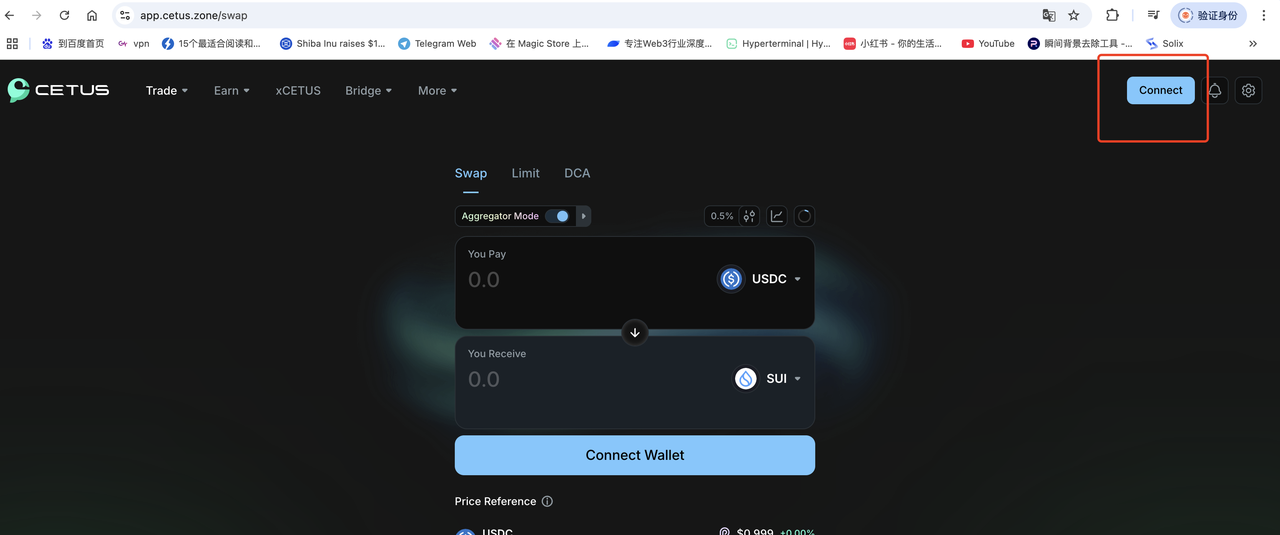

1. Connect Your Wallet

- Use the same wallet that holds your token (you'll deposit tokens into the pool).

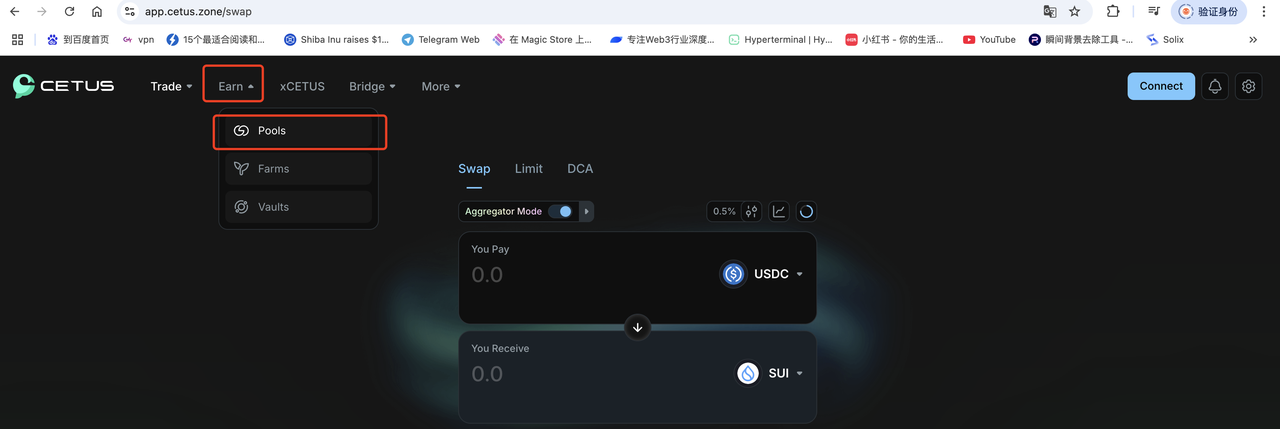

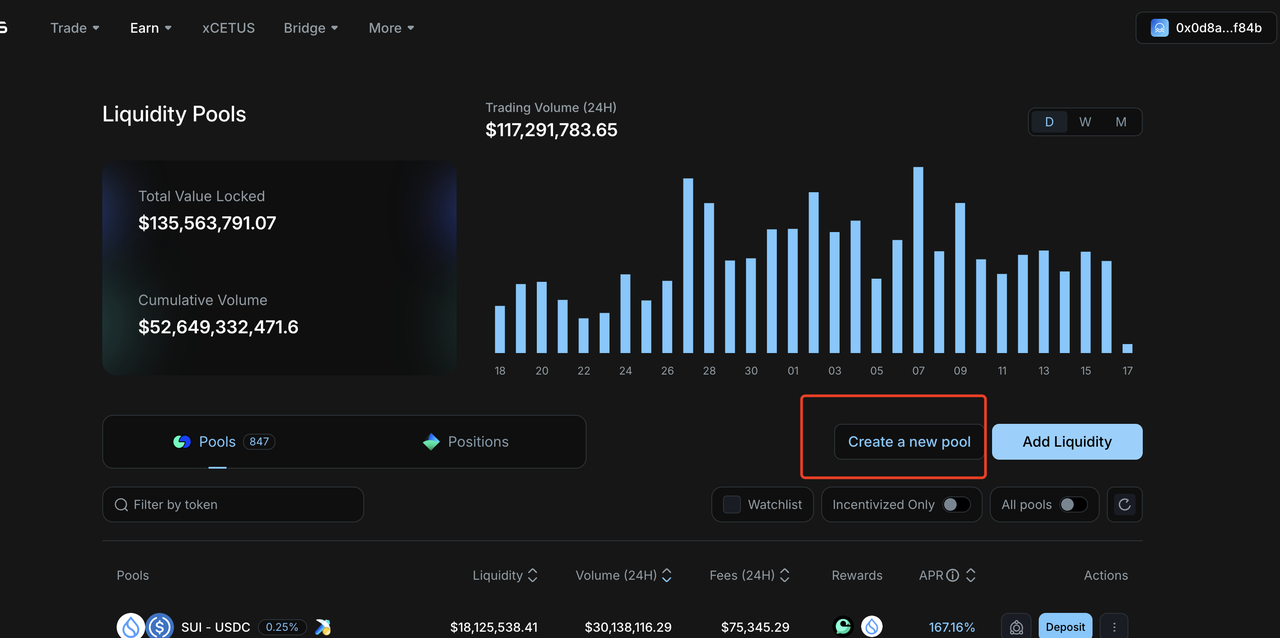

2. Navigate to Pool Creation

- Click Earn → Pools → Create New Pool.

3. Set Up the Trading Pair

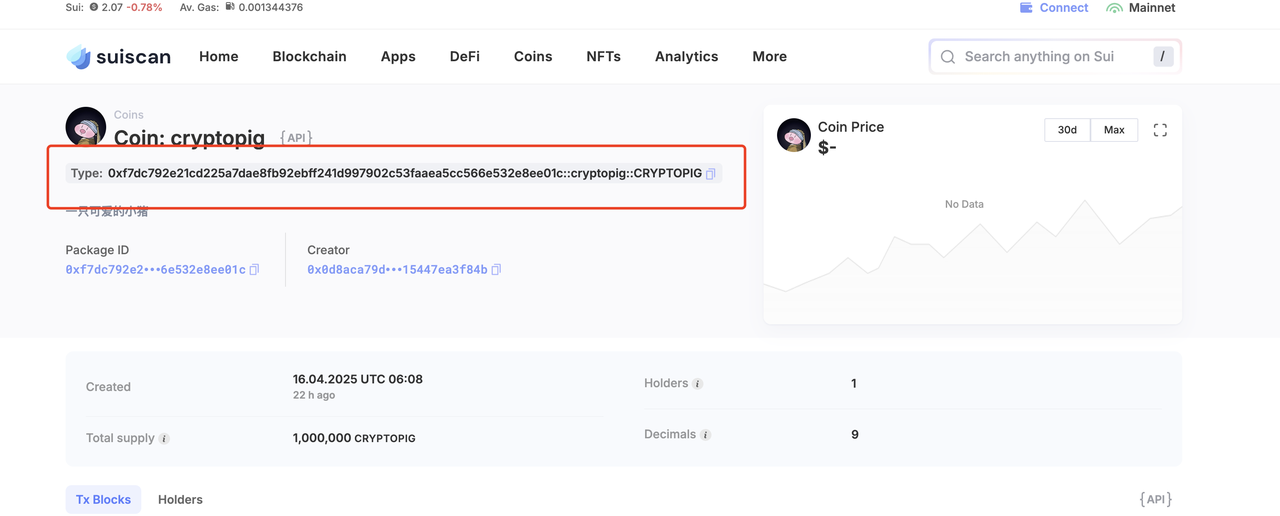

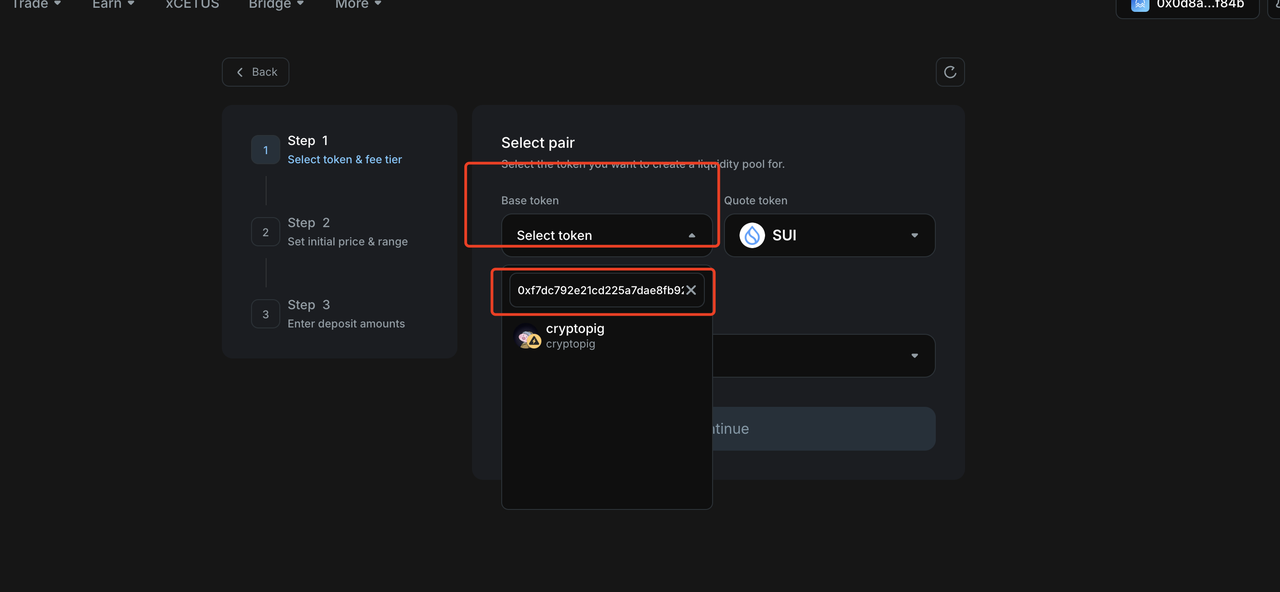

- Token Selection: Paste your token's full contract address (include the

::suffix from SuiScan's "Type" field).

- Quote Token: Default is SUI (or choose USDC).

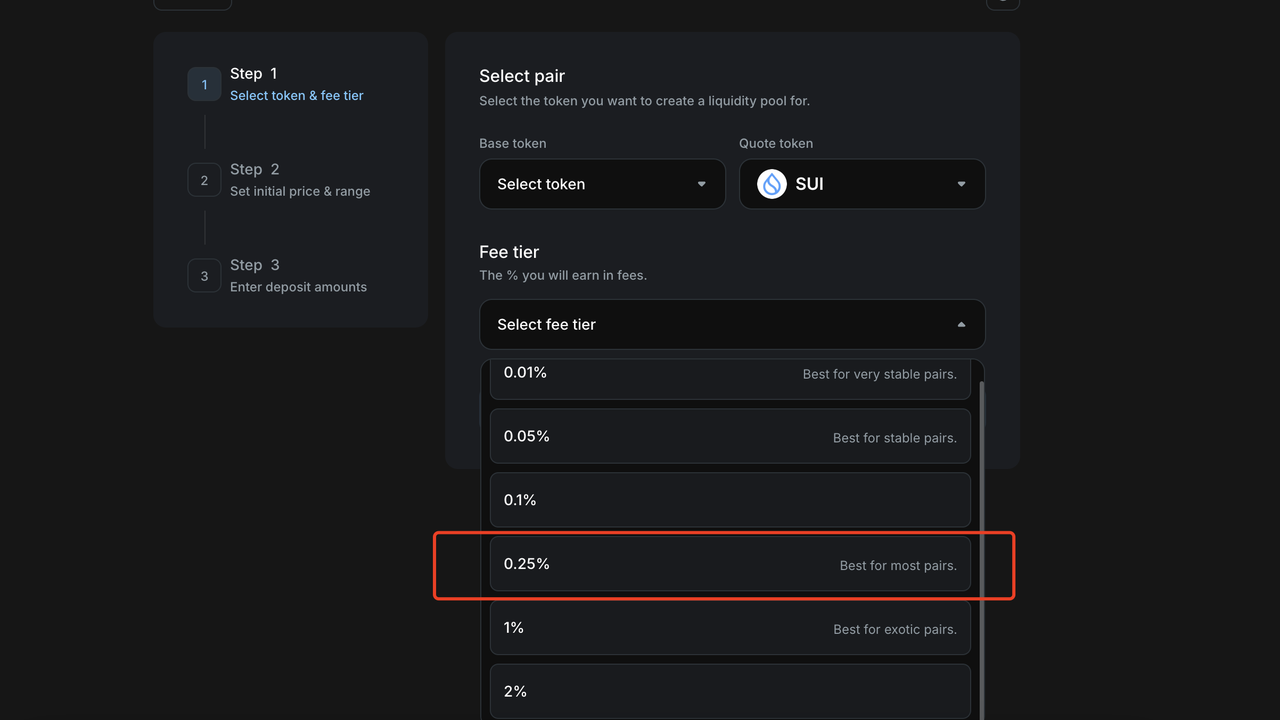

4. Configure Slippage

- Stablecoins: 0.01–0.05% (low volatility).

- Meme Tokens: 0.25–1% (high volatility, ensures trades execute).

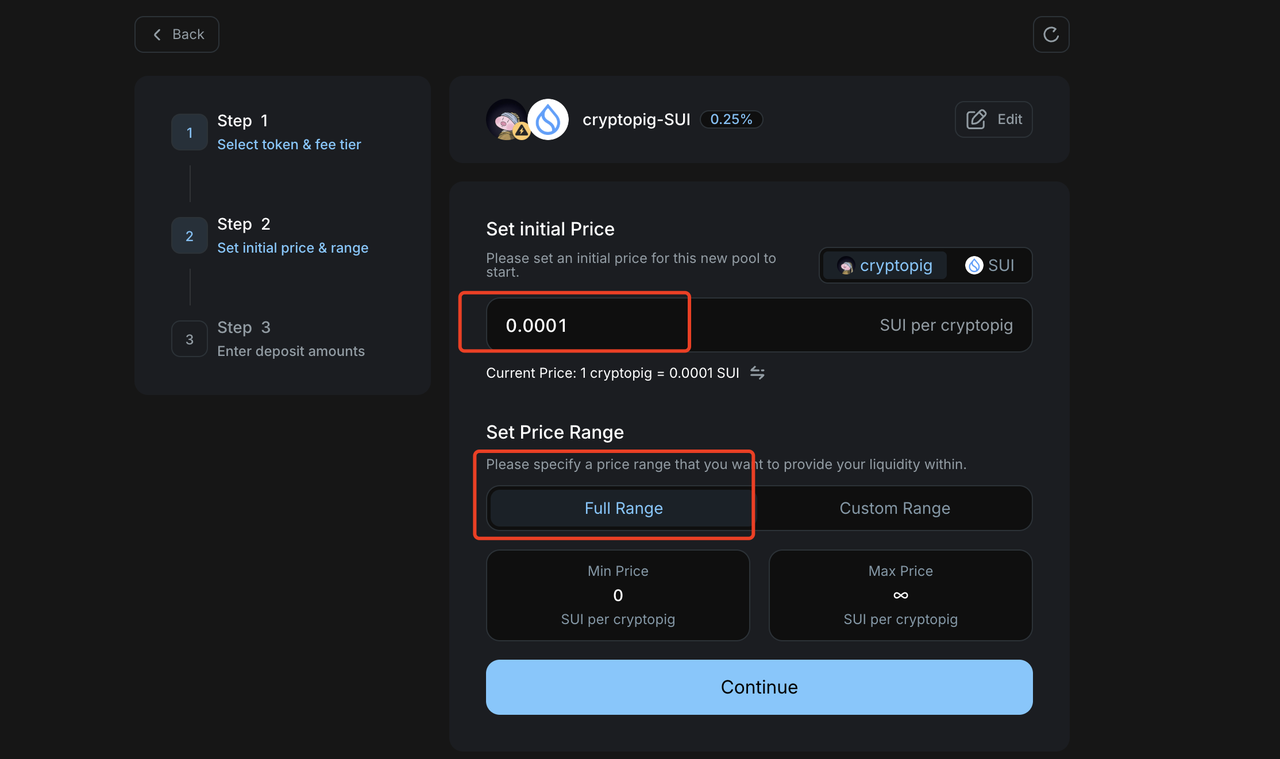

5. Set Initial Price & Range

- Price: E.g.,

1 Token = 0.0001 SUI(1 SUI buys 10K tokens).

- Range: Select Full Range for unlimited trading.

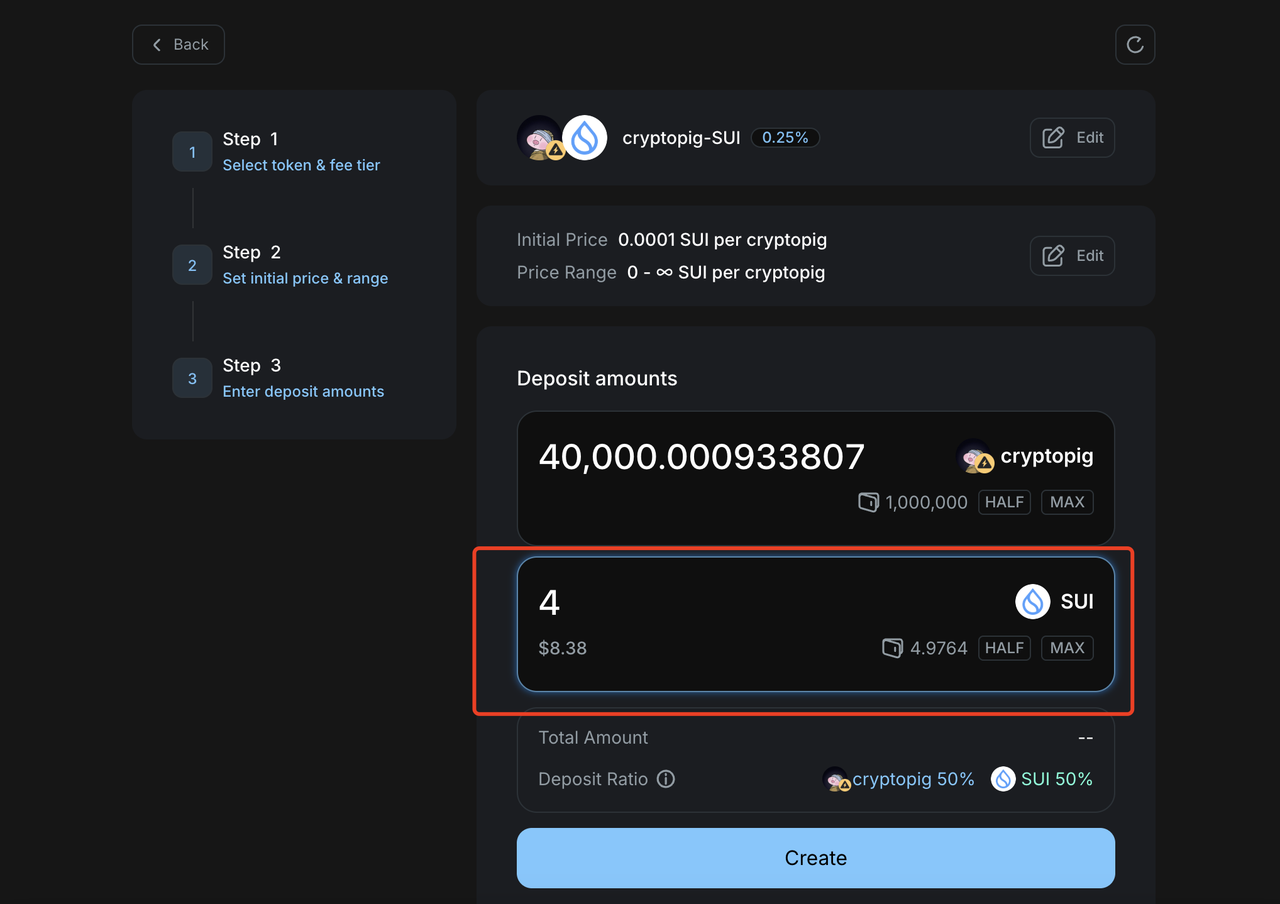

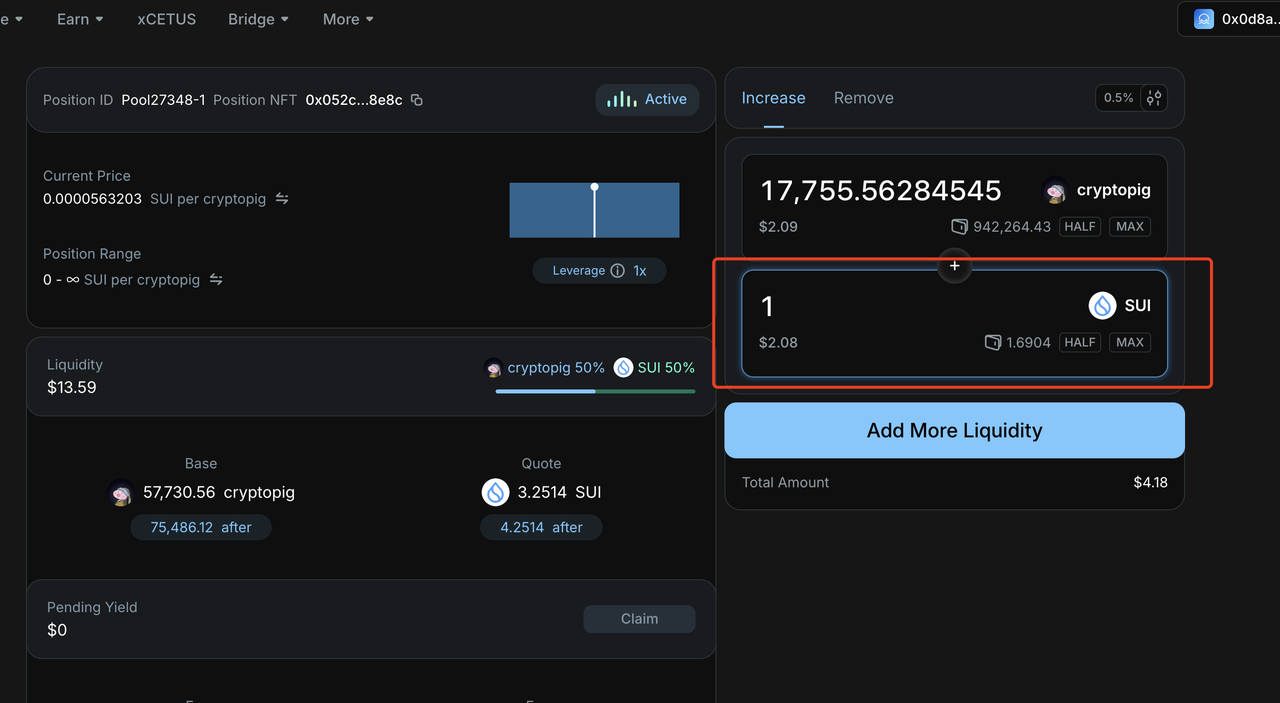

6. Deposit Liquidity

- Example: Add 4 SUI + 40K Tokens (auto-calculated).

- Sign the transaction → Pool is live!

Trading & Managing Liquidity

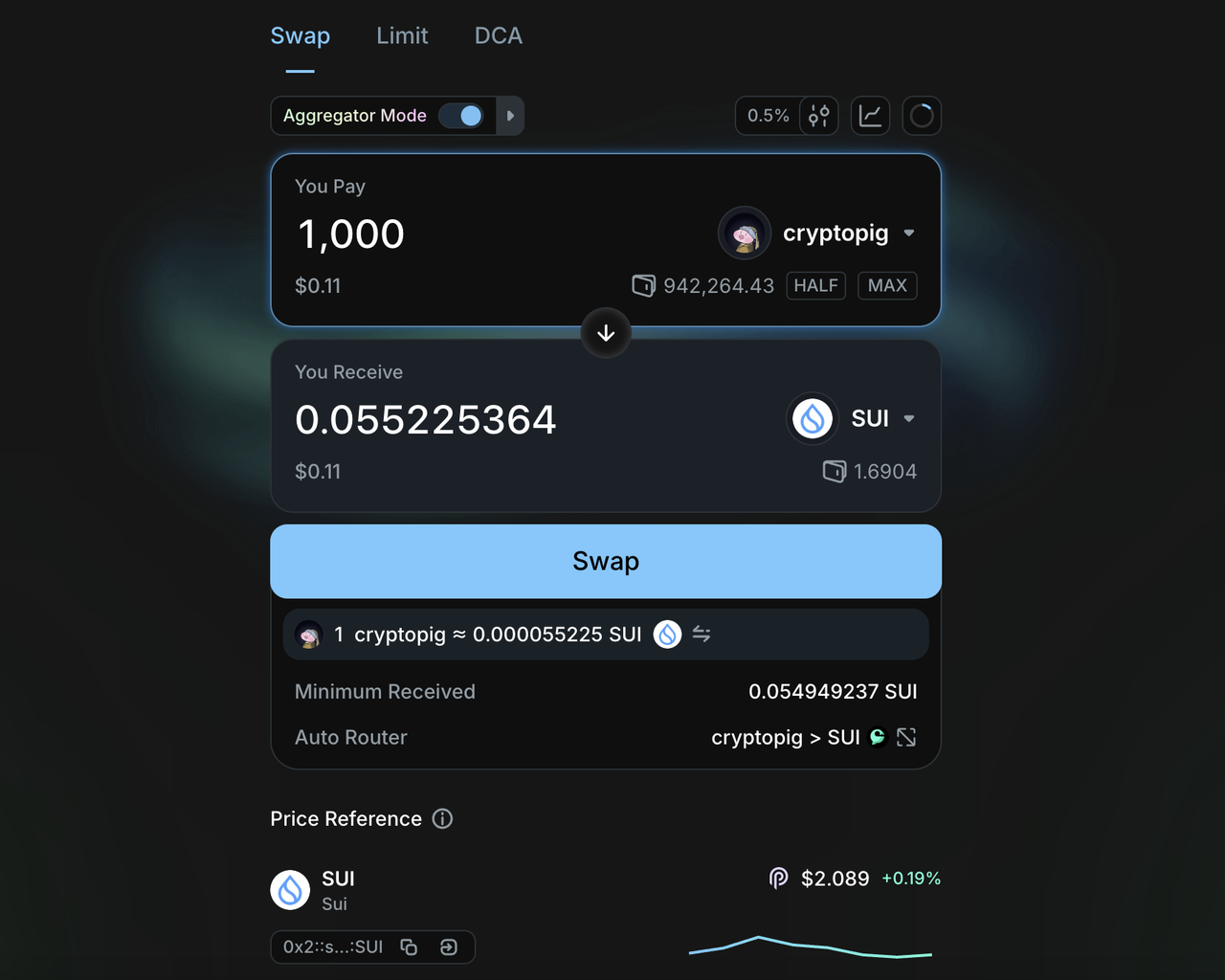

- Test Trading: Go to Swap to buy/sell your token (note: small pools have high slippage).

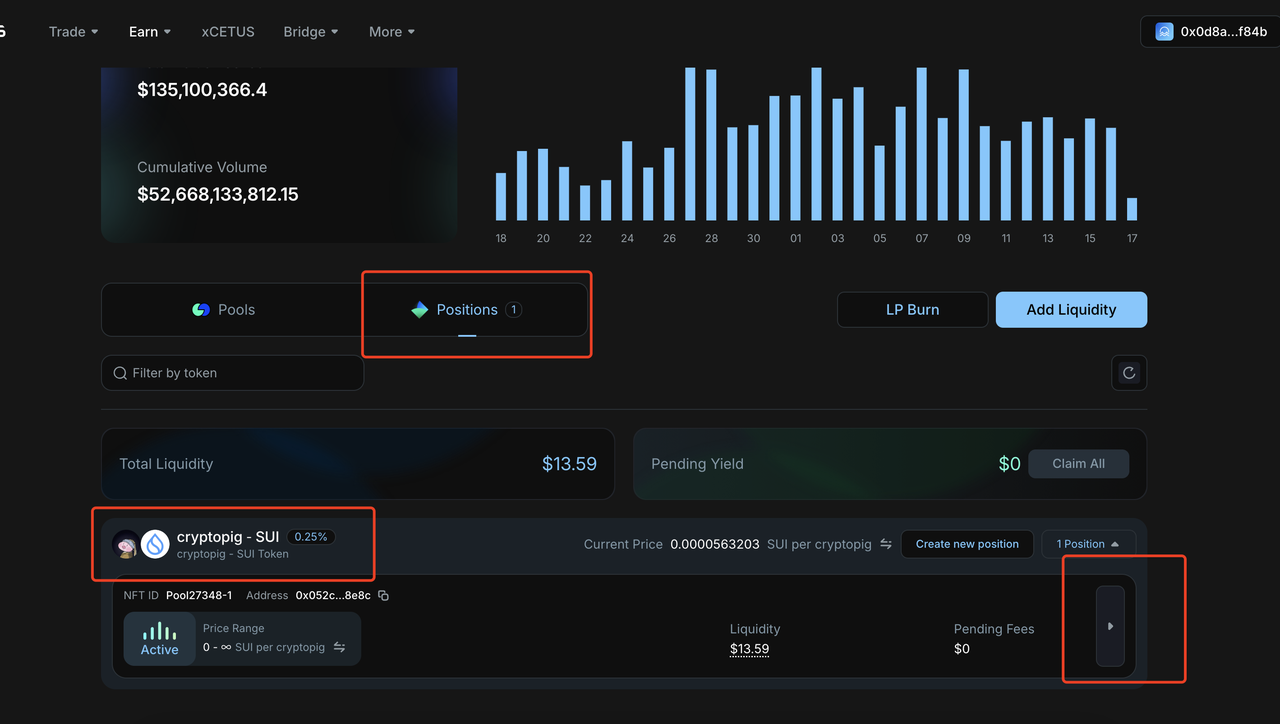

Add/Remove Liquidity:

- Add: Increases depth (reduces slippage) but doesn't raise token price.

- Remove: Withdraw funds (risks price crashes if done abruptly).

When to Remove Liquidity?

- Legitimate: Protocol upgrades, security fixes, or project sunsetting.

- Risks: Sudden removals can trigger rug pull accusations or token collapse.

Advanced: Liquidity Staking

- Traditional Staking: Locks tokens (no trading).

- Liquidity Staking:

- Deposit tokens into a pool → get LP Tokens.

- Stake LP Tokens to earn:

- Trading fees (0.3% per swap).

- Bonus rewards (e.g., project incentives).

Key Takeaways

- Liquidity pools turn tokens into tradable assets.

- Cetus simplifies pool creation but requires manual setup.

- DYOR: Balance liquidity depth with decentralization.

_For LP Token mechanics, read:

Understanding Liquidity Pools, AMMs, and Liquidity Mining

Learn More About CPBOX

Explore features: https://docs.cpbox.io

Suggestions or custom needs?

Contact us:https://www.cpbox.io/cn/

Join Our Community

Telegram Group: https://t.me/cpboxio

Twitter: https://twitter.com/Web3CryptoBox | https://x.com/cpboxio

YouTube: https://youtube.com/channel/UCDcg1zMH4CHTfuwUpGSU-wA