Pump Market Cap Management

Market Cap Management Overview

In the digital currency market, market cap management is one of the core concerns for project teams. Effective market cap management not only stabilizes token prices but also attracts more investor attention, driving long-term project growth. The Pump Market Cap Management feature on CPBox.io is a professional tool designed to address these market challenges.

Use Cases

CPBox.io's Pump Market Cap Management is a comprehensive solution for digital asset projects. Utilizing smart algorithms and professional trading strategies, it helps project teams effectively regulate token prices and market capitalization under various market conditions.

Applicable Scenarios:

- New Project Launch: Stabilizes prices and builds market confidence during initial token release.

- Major Positive Announcements: Amplifies positive impacts alongside marketing campaigns.

- Market Downturns: Prevents excessive price drops and maintains investor confidence.

- Long-Term Growth Plans: Gradually increases token value through sustained strategic interventions.

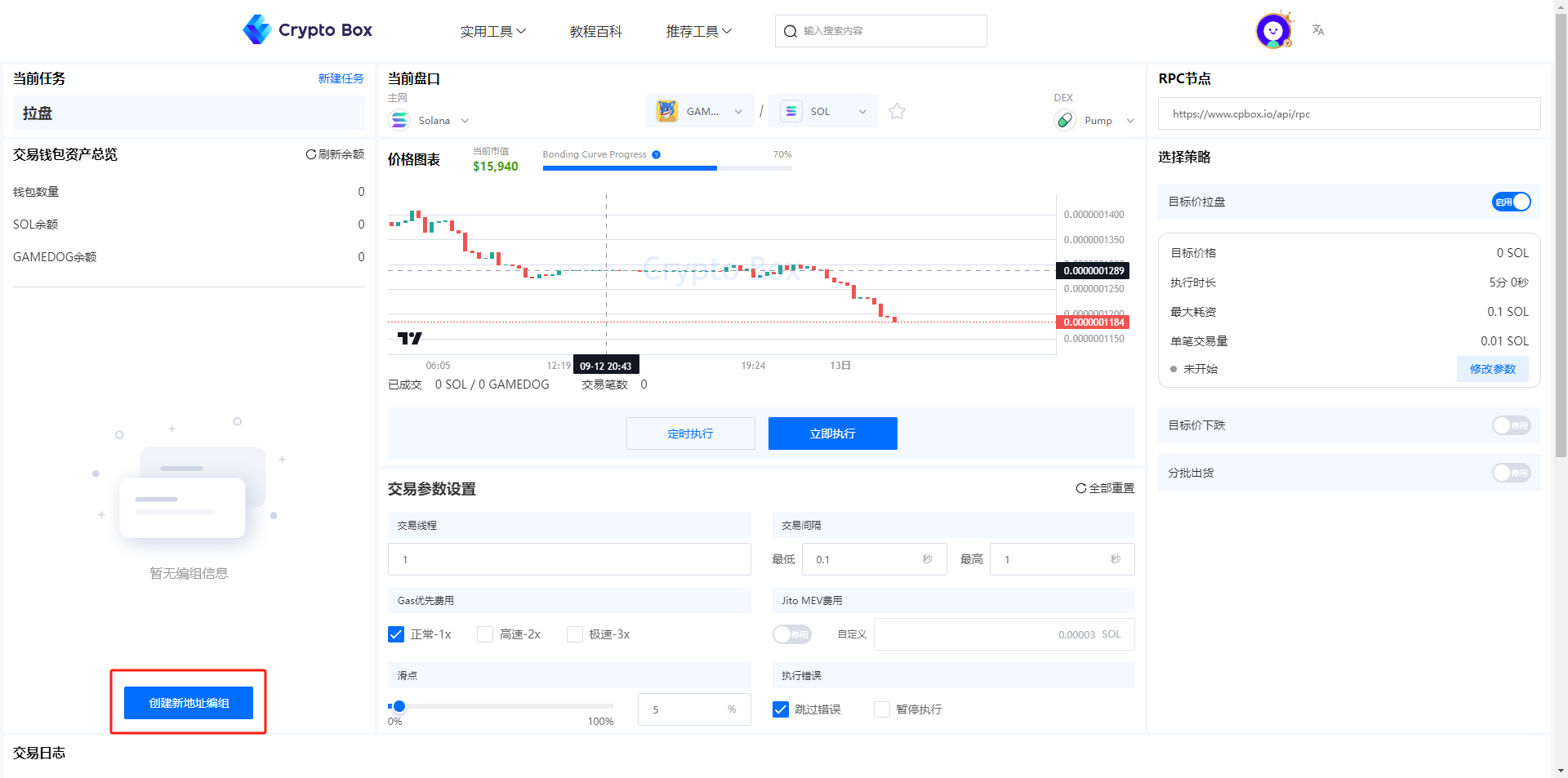

User Guide

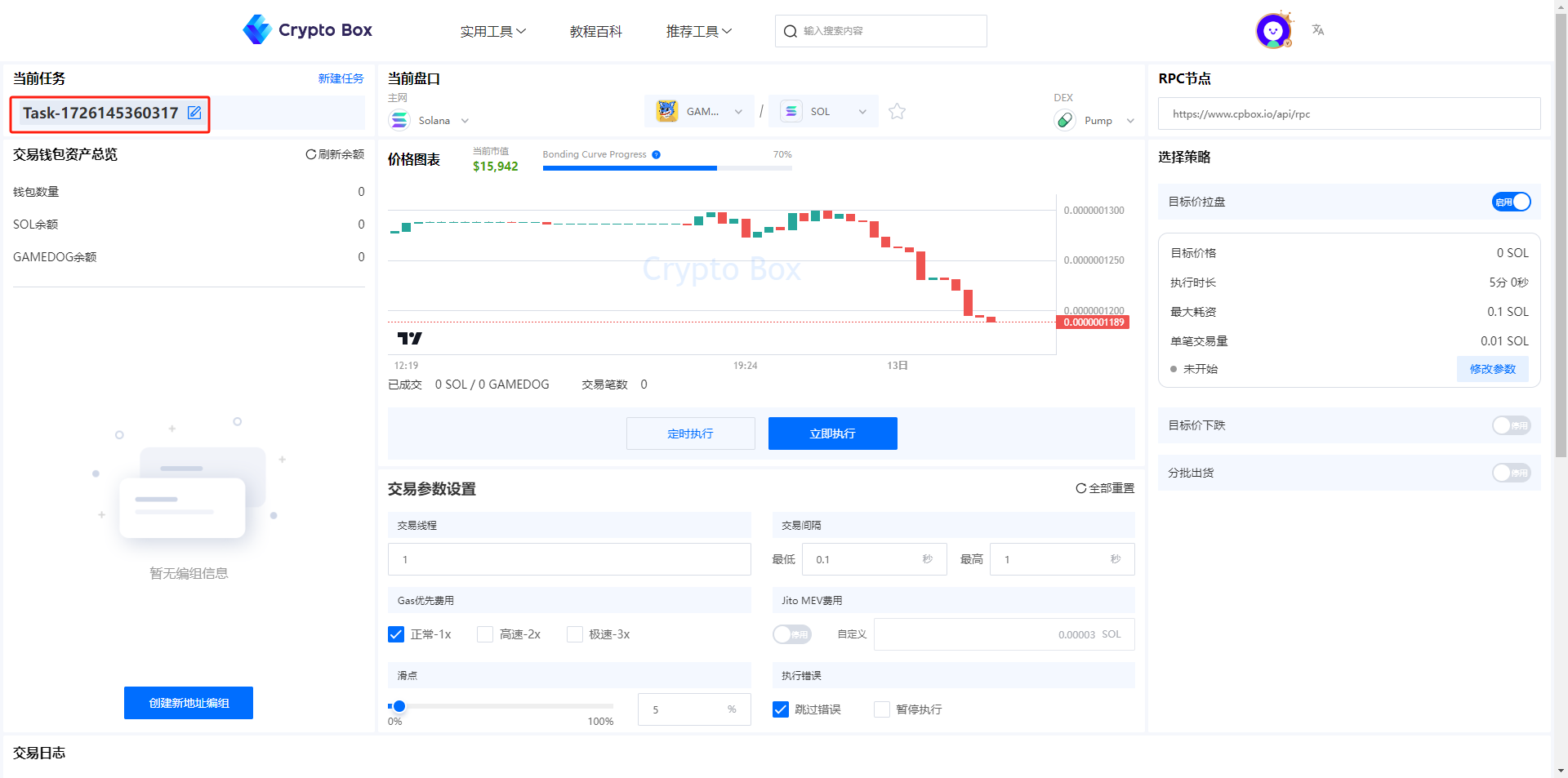

First-Time Users:

- The system automatically creates a task upon first access. Go BMM>>

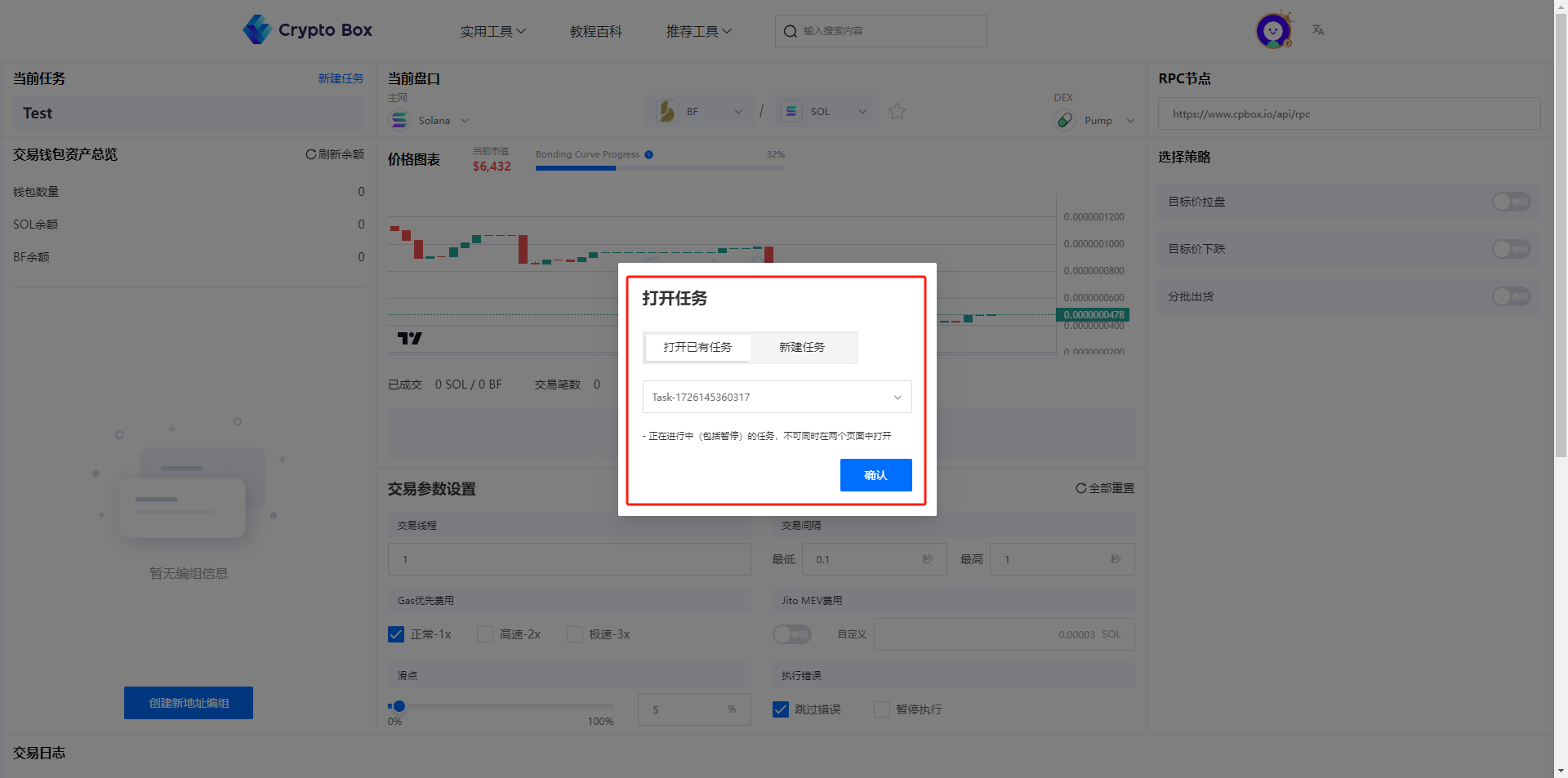

Returning Users:

- Choose between resuming a historical task or creating a new one.

Returning Users:

- Choose between resuming a historical task or creating a new one.

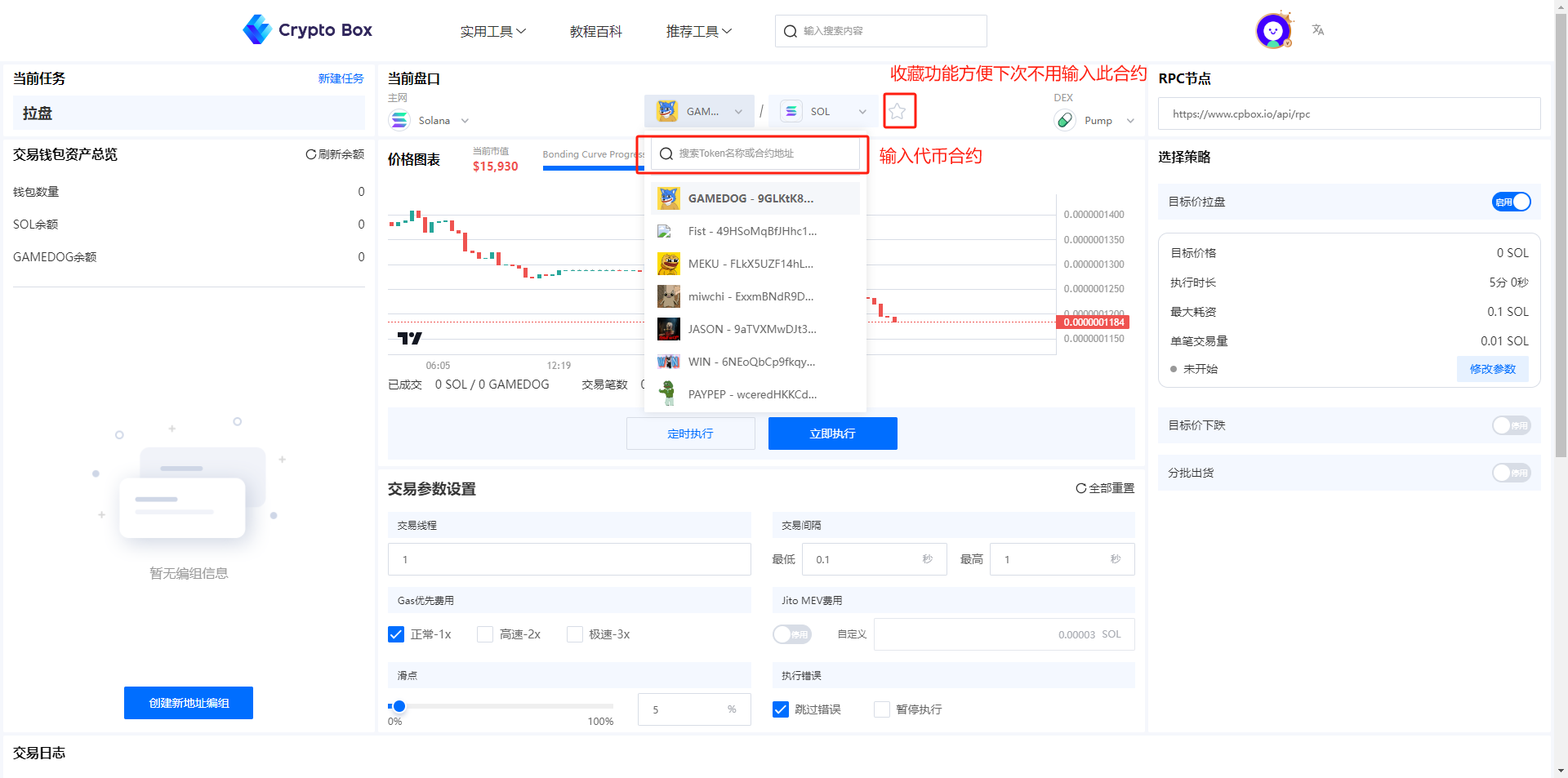

Token Contract Configuration:

- Enter the token contract address.

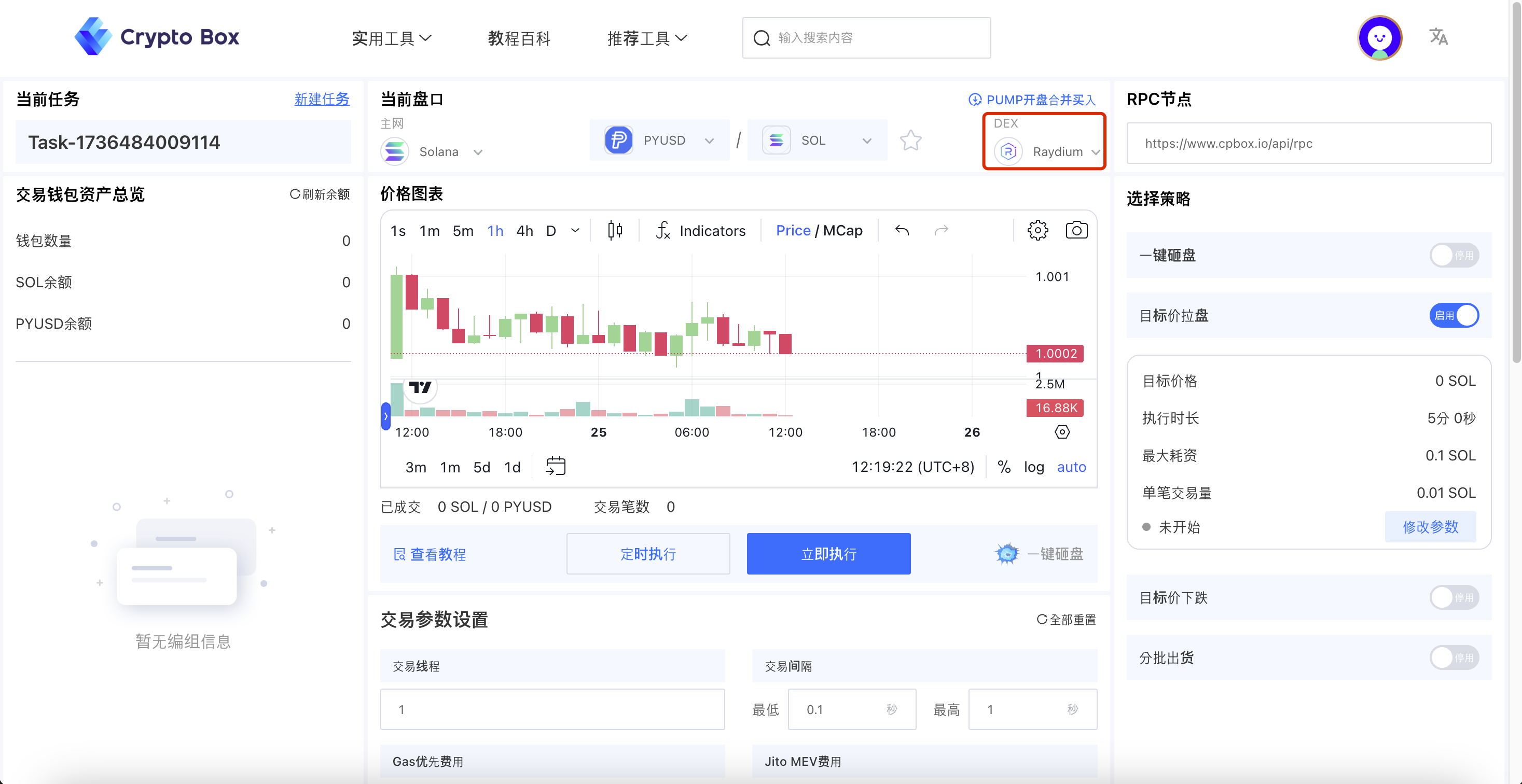

- If the token is already listed on Raydium (external market), select Raydium under DEX options.

Select DEX

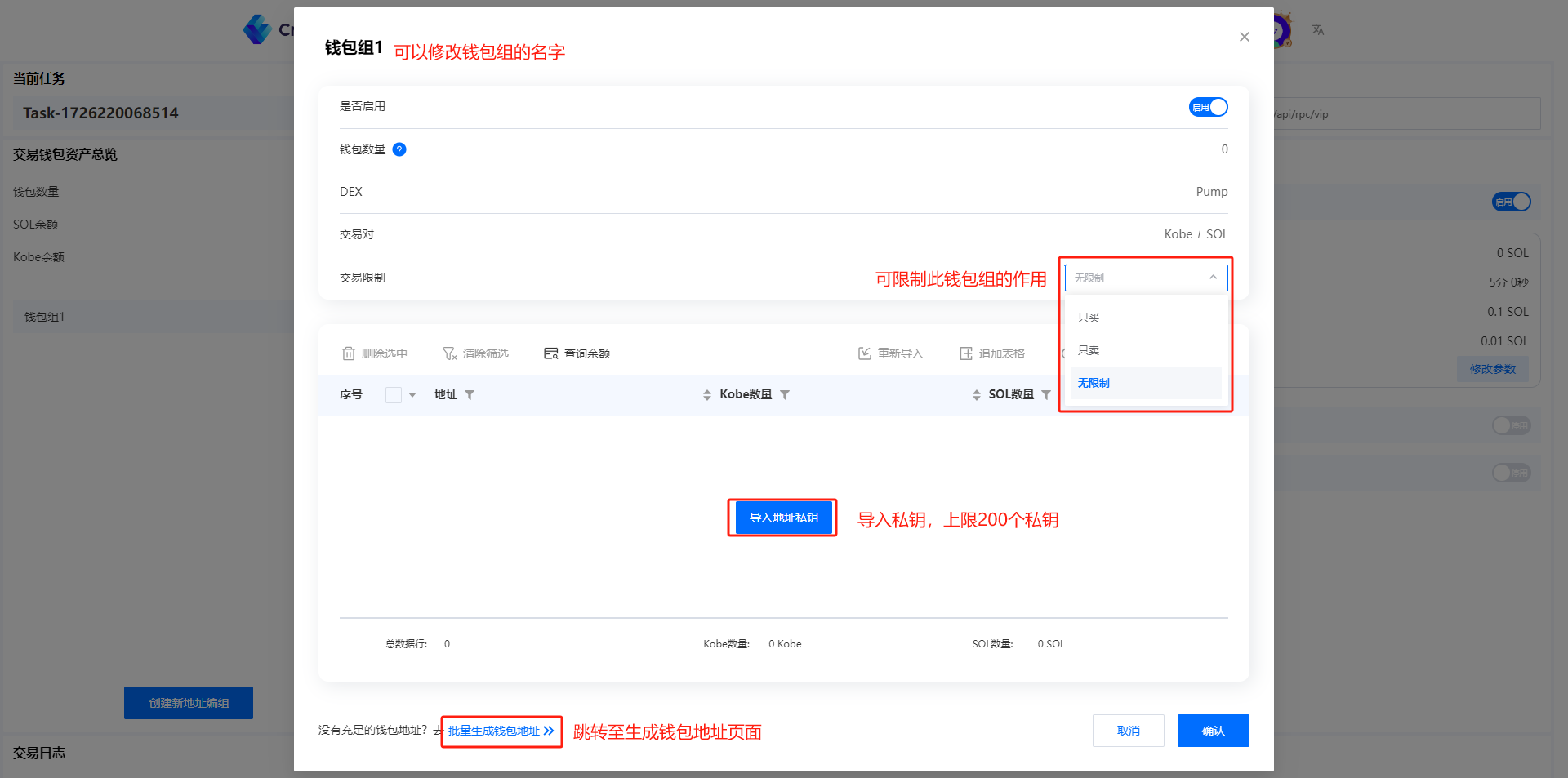

Wallet Private Key Import:

- Import the private keys of wallets to be used for market making operations.

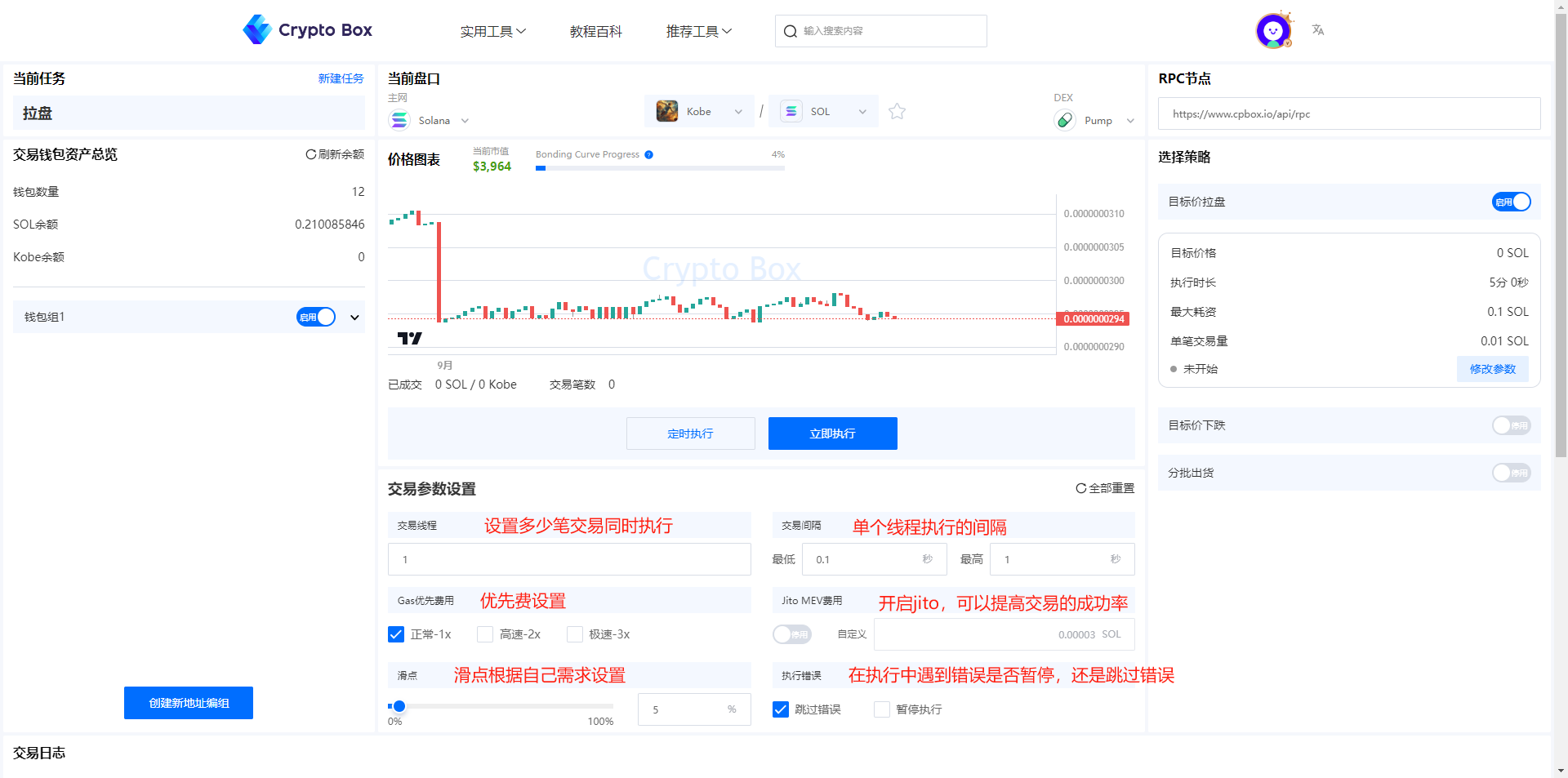

Basic Trading Parameters:

- Slippage Tolerance: Adjust acceptable price fluctuations for buy/sell orders to optimize execution.

Basic parameter settings

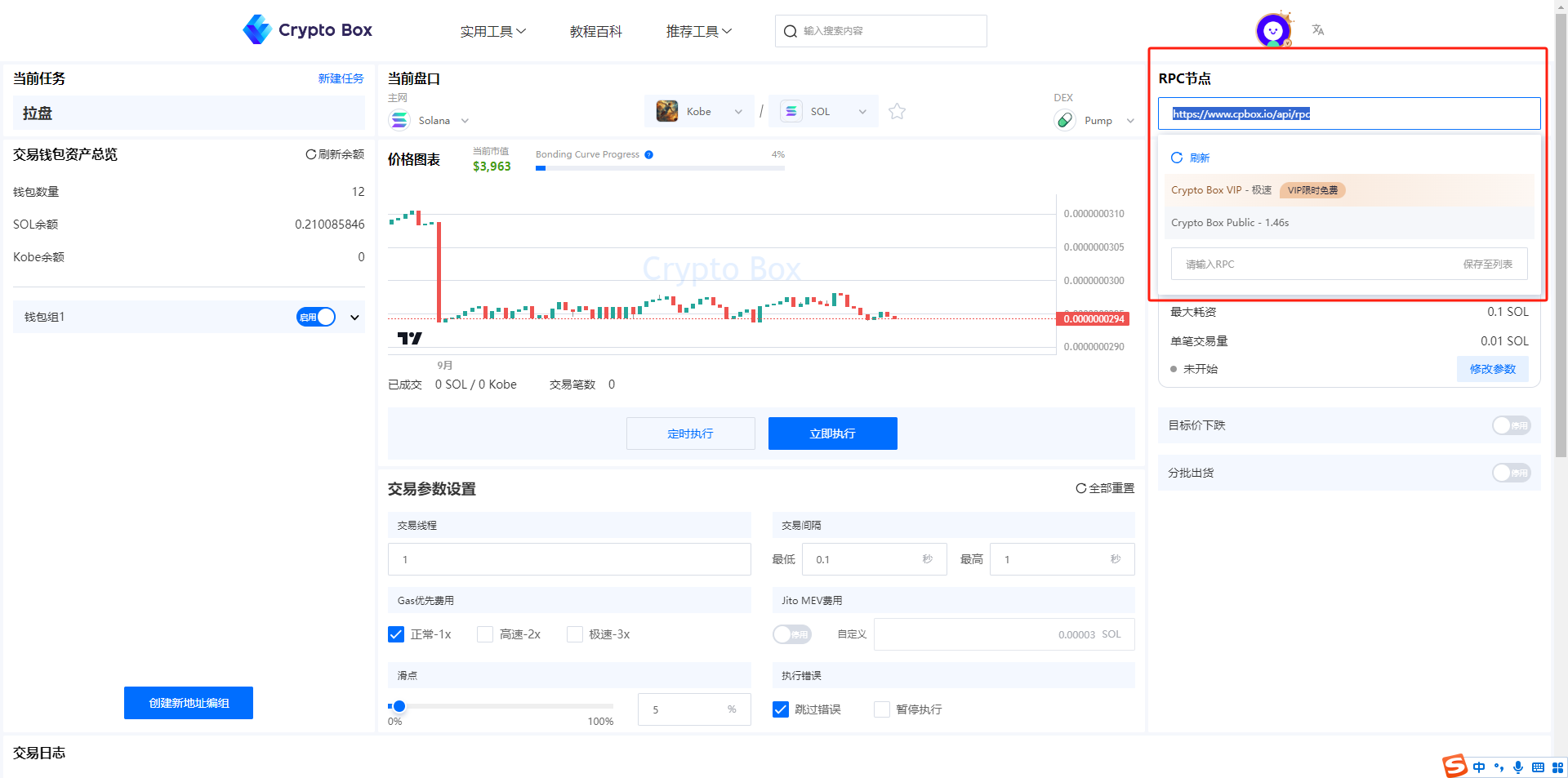

RPC Node Configuration:

- VIP Users: Access exclusive high-speed VIP nodes for optimal performance.

- Custom Option: Import and configure private RPC nodes.

RPC selection

Trading Strategies

CPBox.io currently offers four comprehensive trading strategies:

- One-Click Dump - Quick liquidation strategy

- Target Price Pump - Price appreciation campaign

- Target Price Drop - Controlled price reduction

- Batch Sell-Off - Systematic distribution strategy

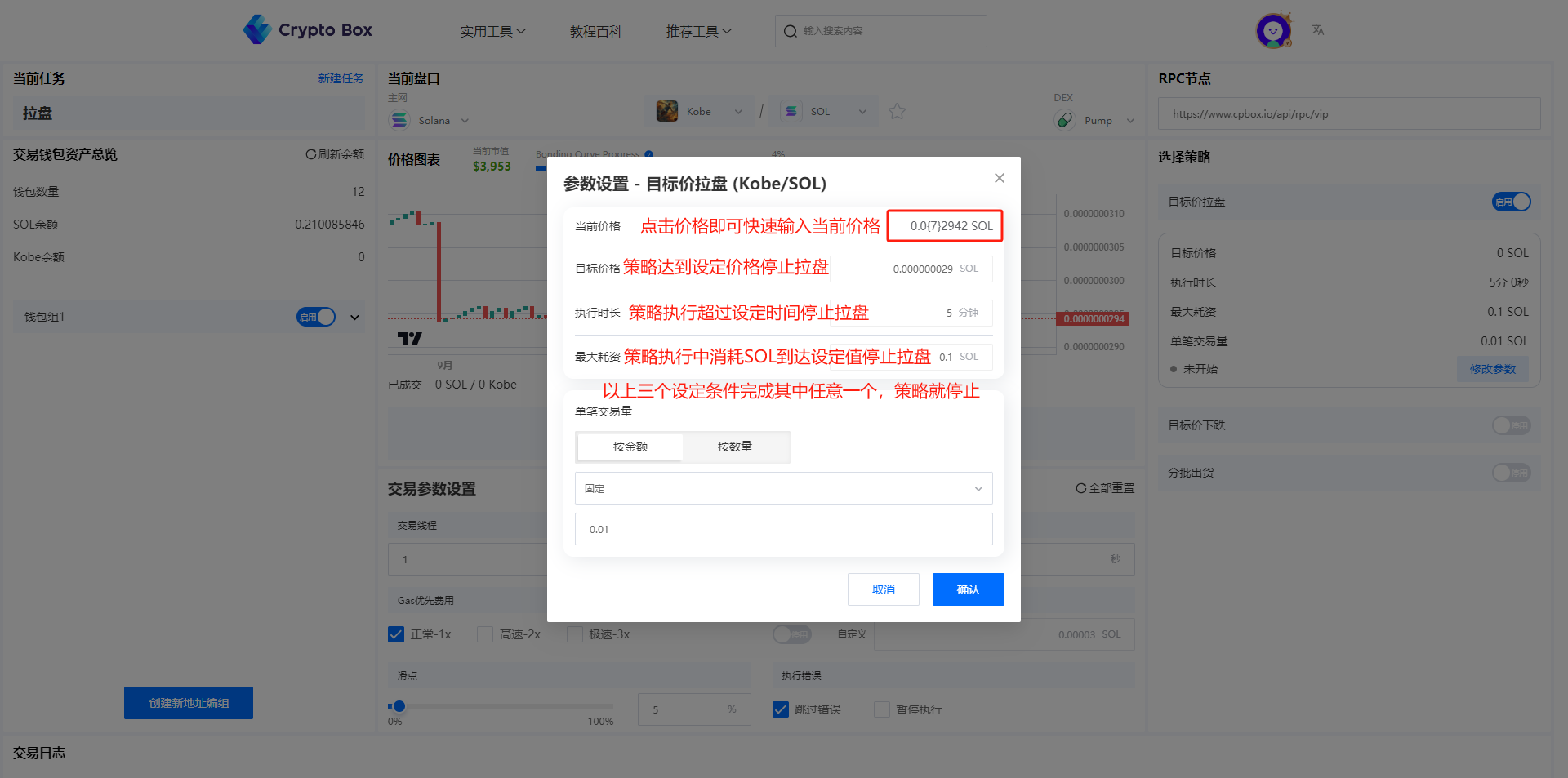

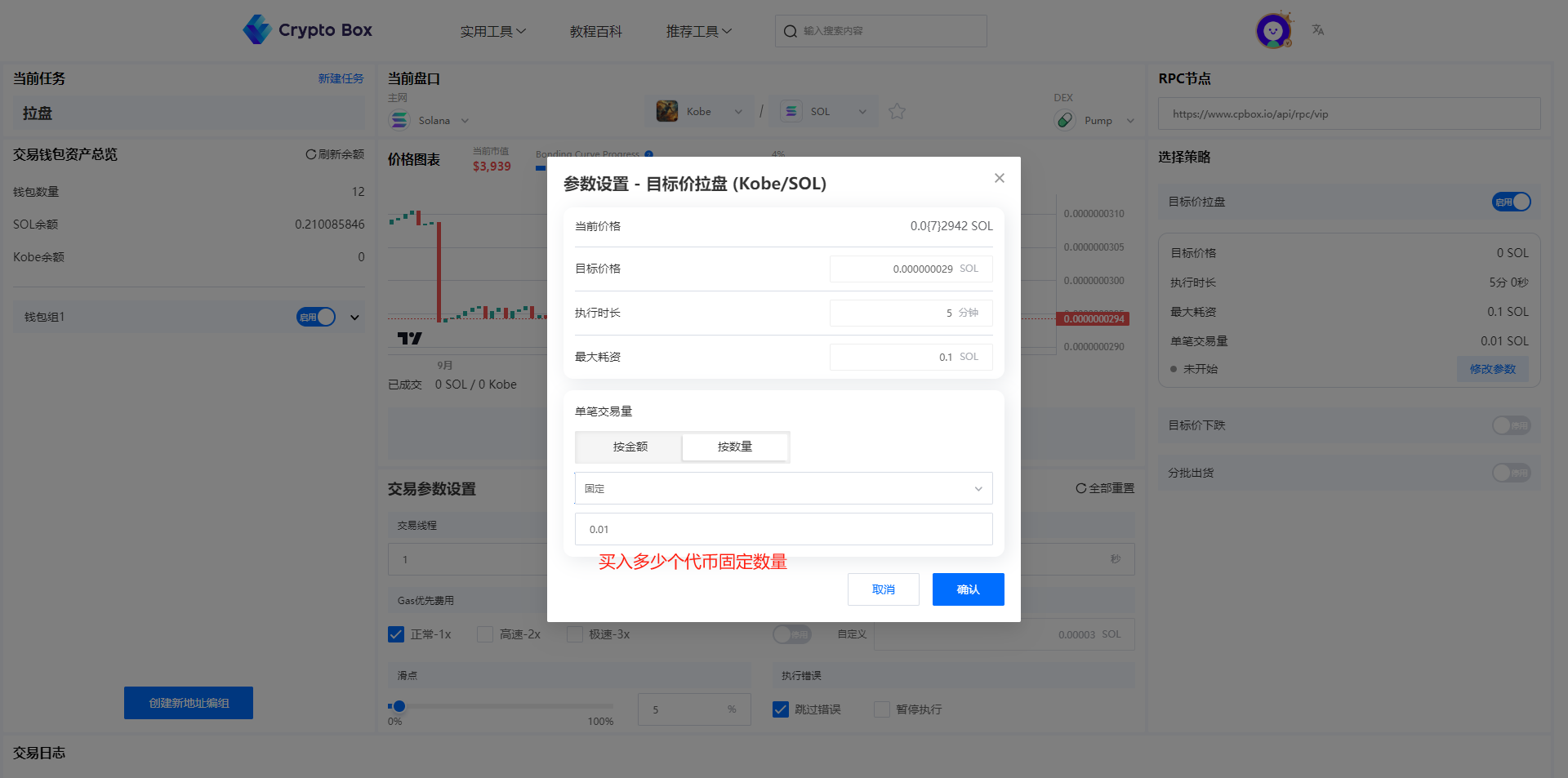

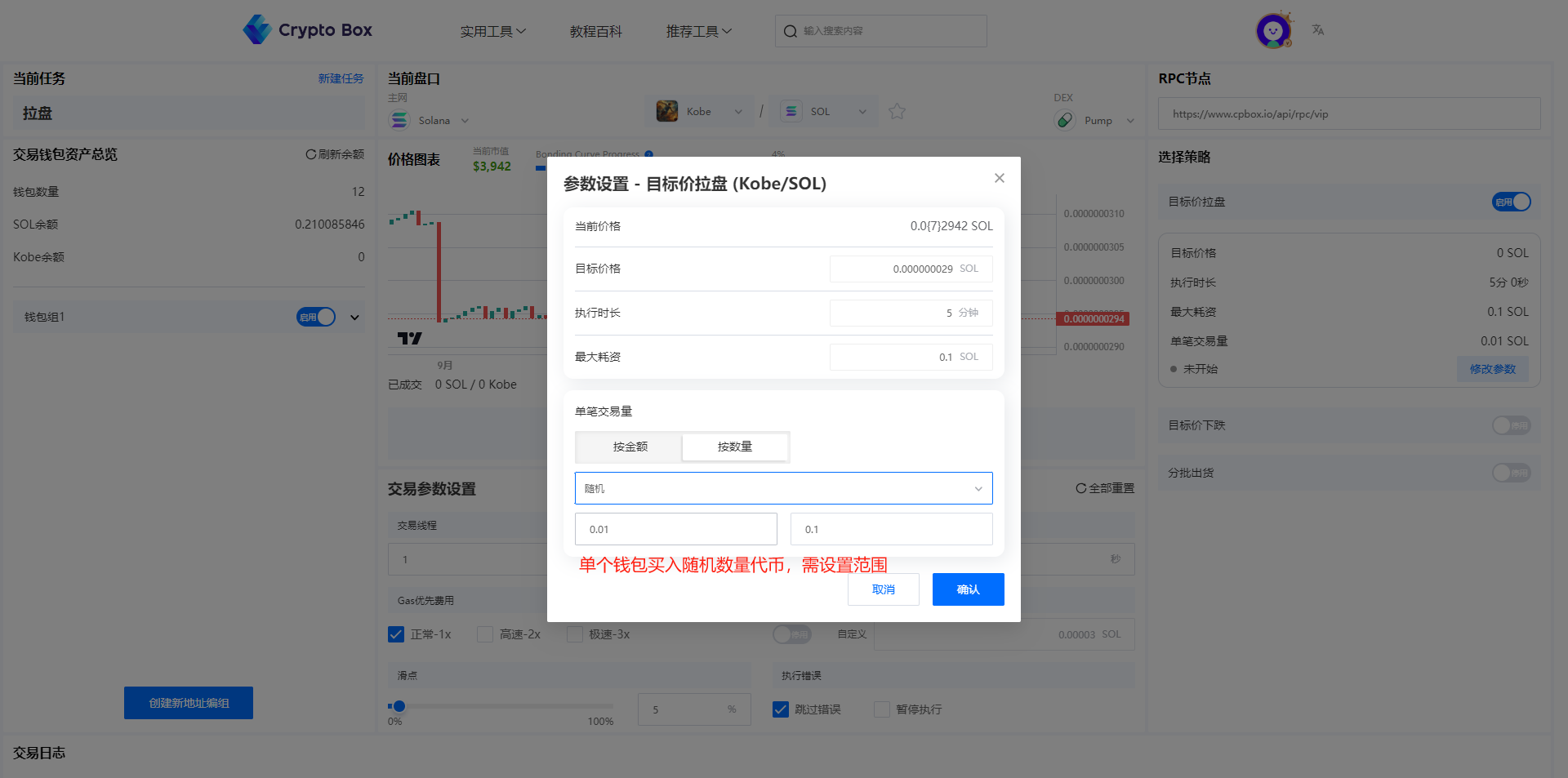

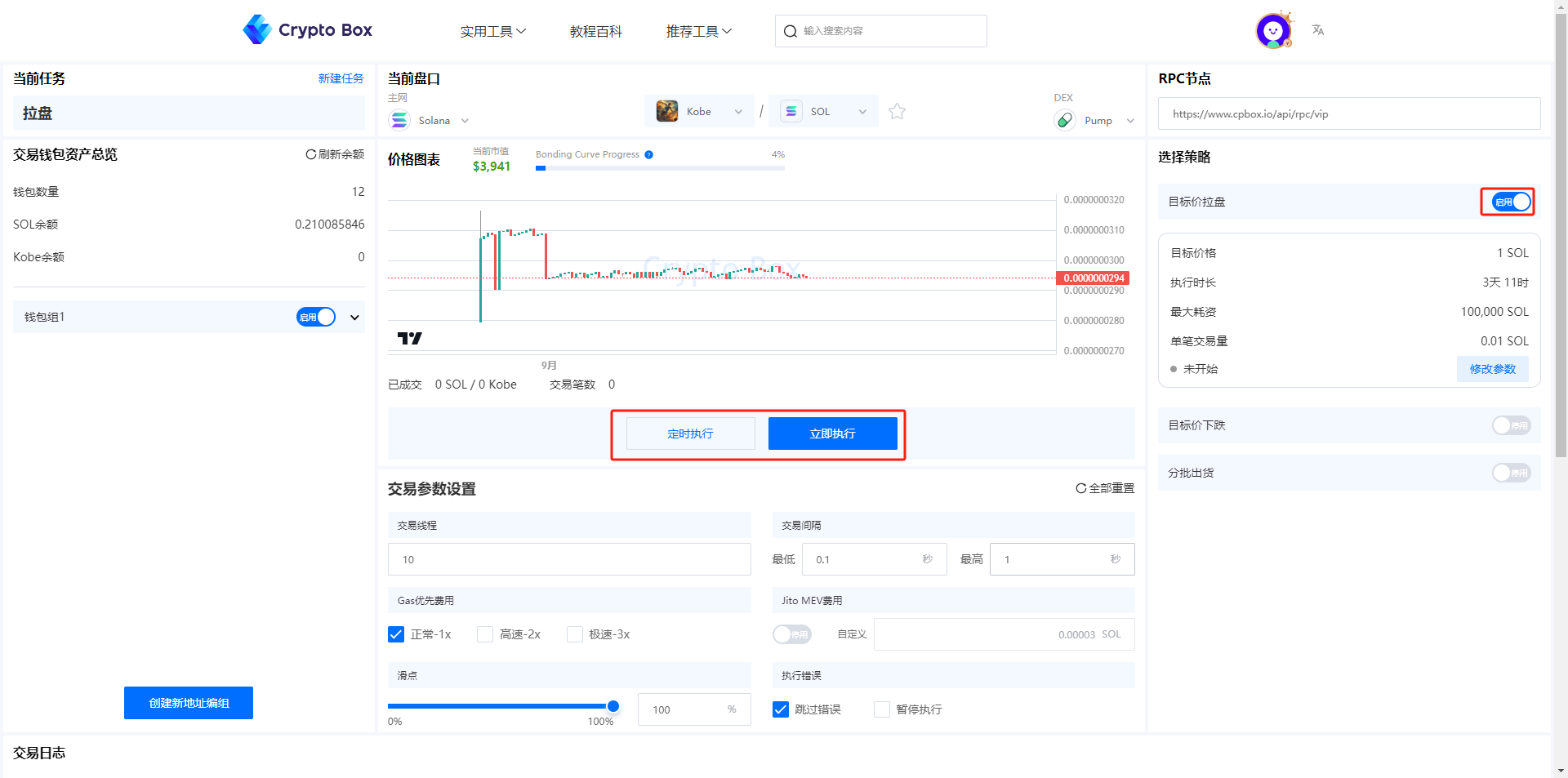

Target Price Pump Strategy

This strategy is designed to systematically increase token price to a predetermined target level.

- Stop Conditions: Configure price thresholds or time-based triggers to halt operations.

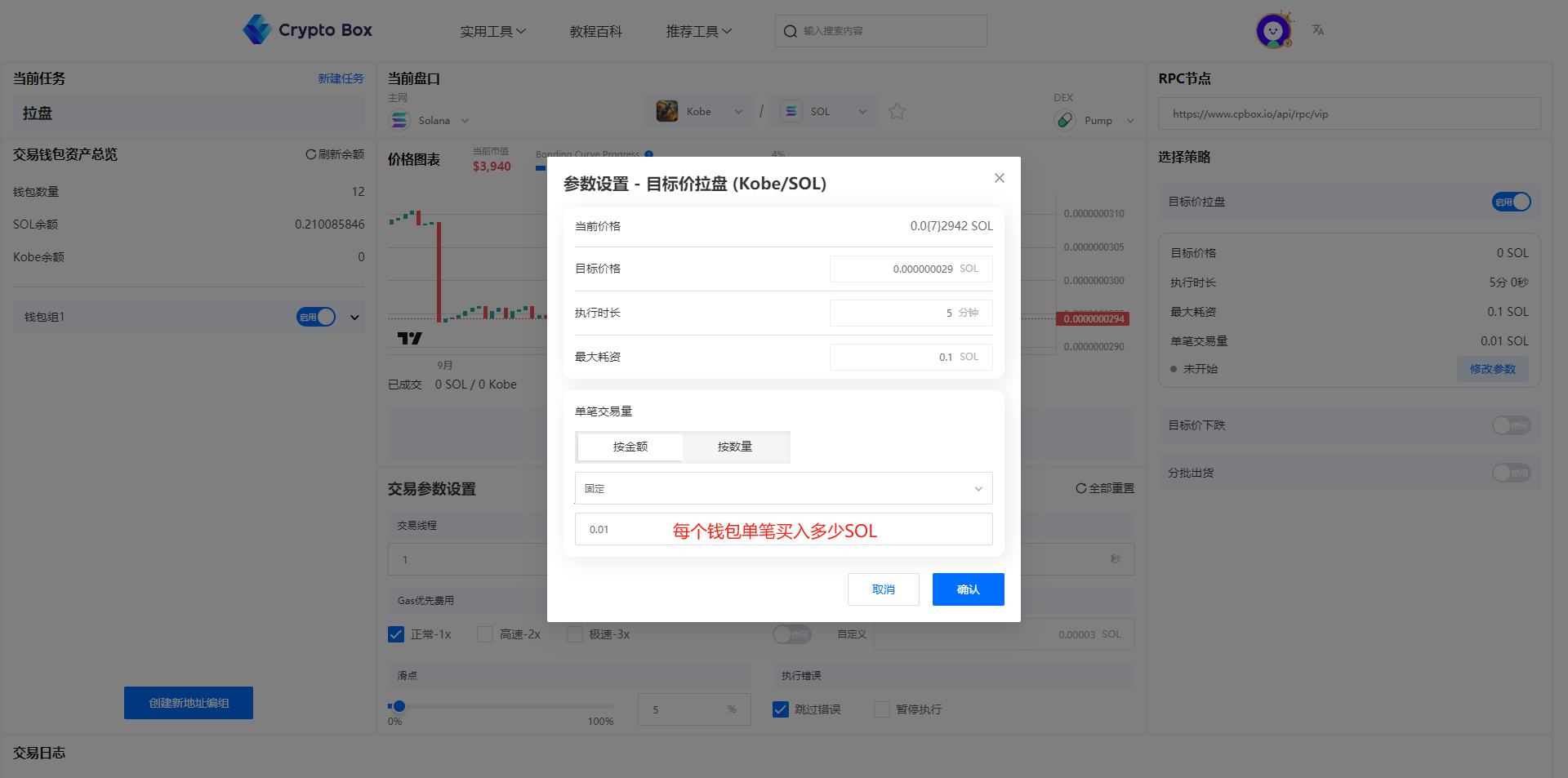

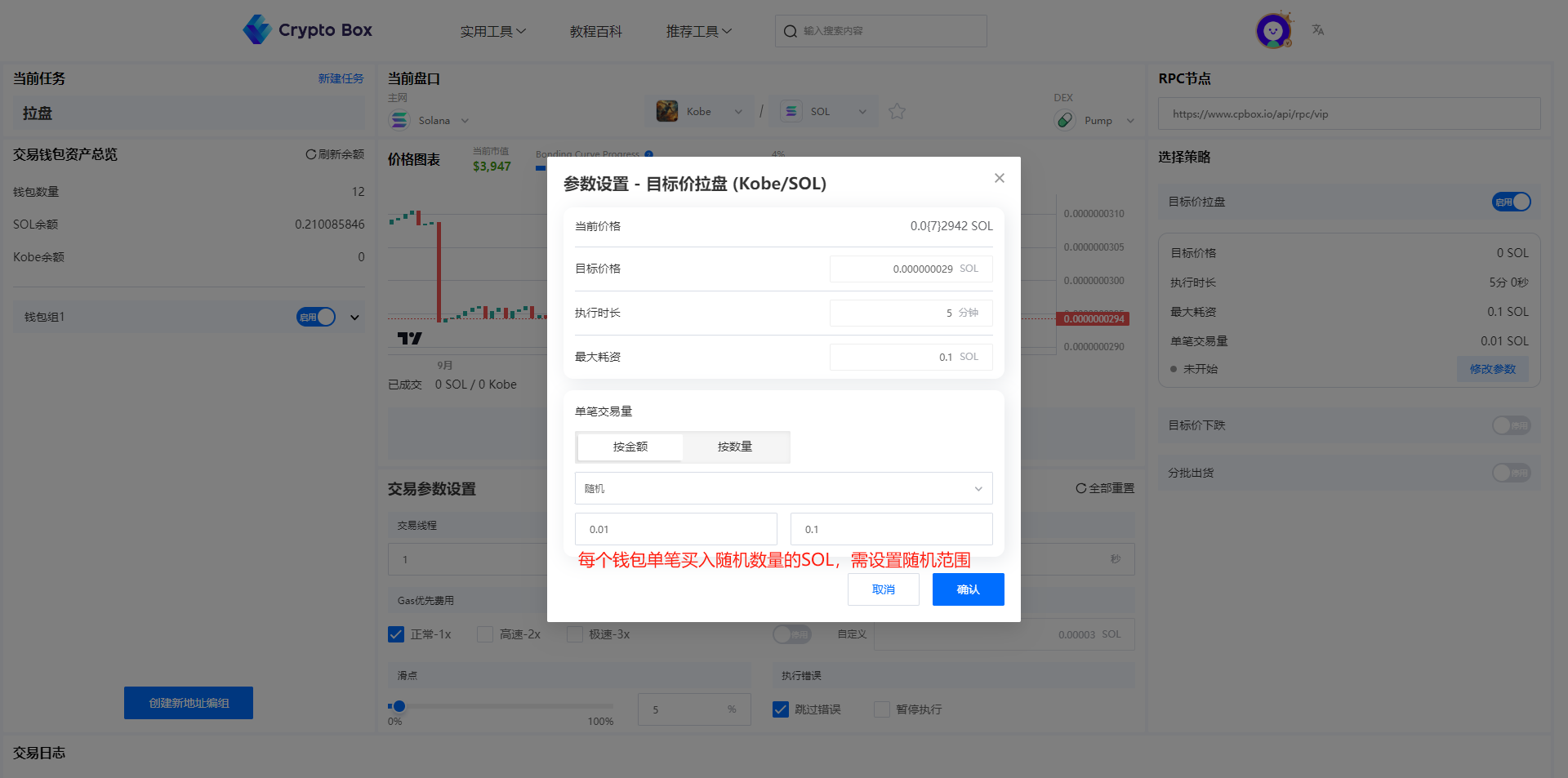

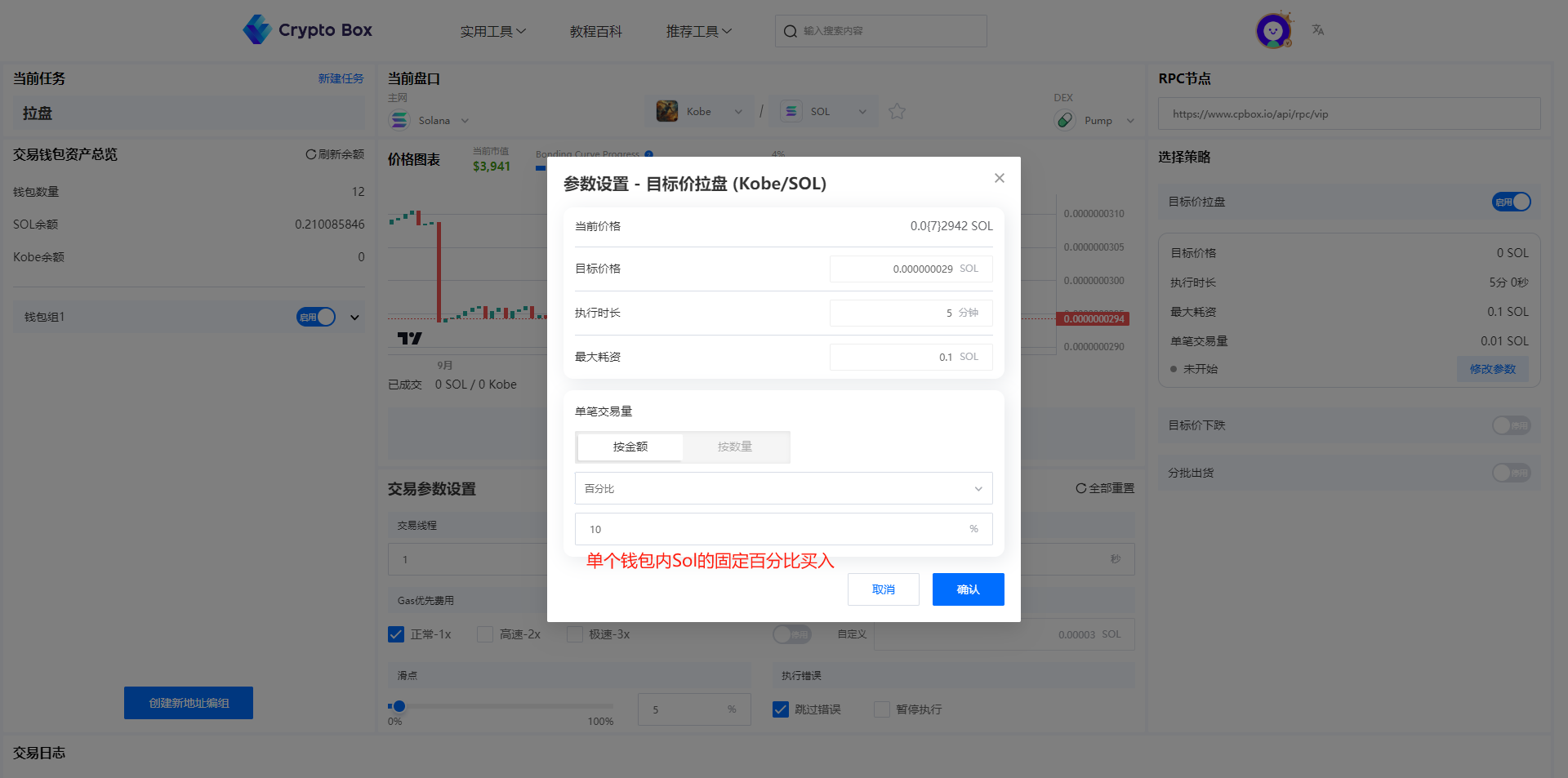

Buy Parameters (Per Wallet Configuration):

Fixed SOL Amount: Set a specific SOL amount for each wallet transaction.

Random SOL Amount: Define a range for randomized SOL amounts to create natural trading patterns.

Fixed Percentage of Wallet SOL Balance: Use a set percentage of each wallet's SOL balance for purchases.

Fixed percentage of wallet balance

Random Percentage of Wallet SOL Balance: Apply randomized percentages within a defined range for varied transaction sizes.

Buy Parameters (Token Quantity Configuration):

Fixed Token Amount: Purchase a predetermined number of tokens per transaction.

Random Token Amount: Set parameters for randomized token purchase quantities.

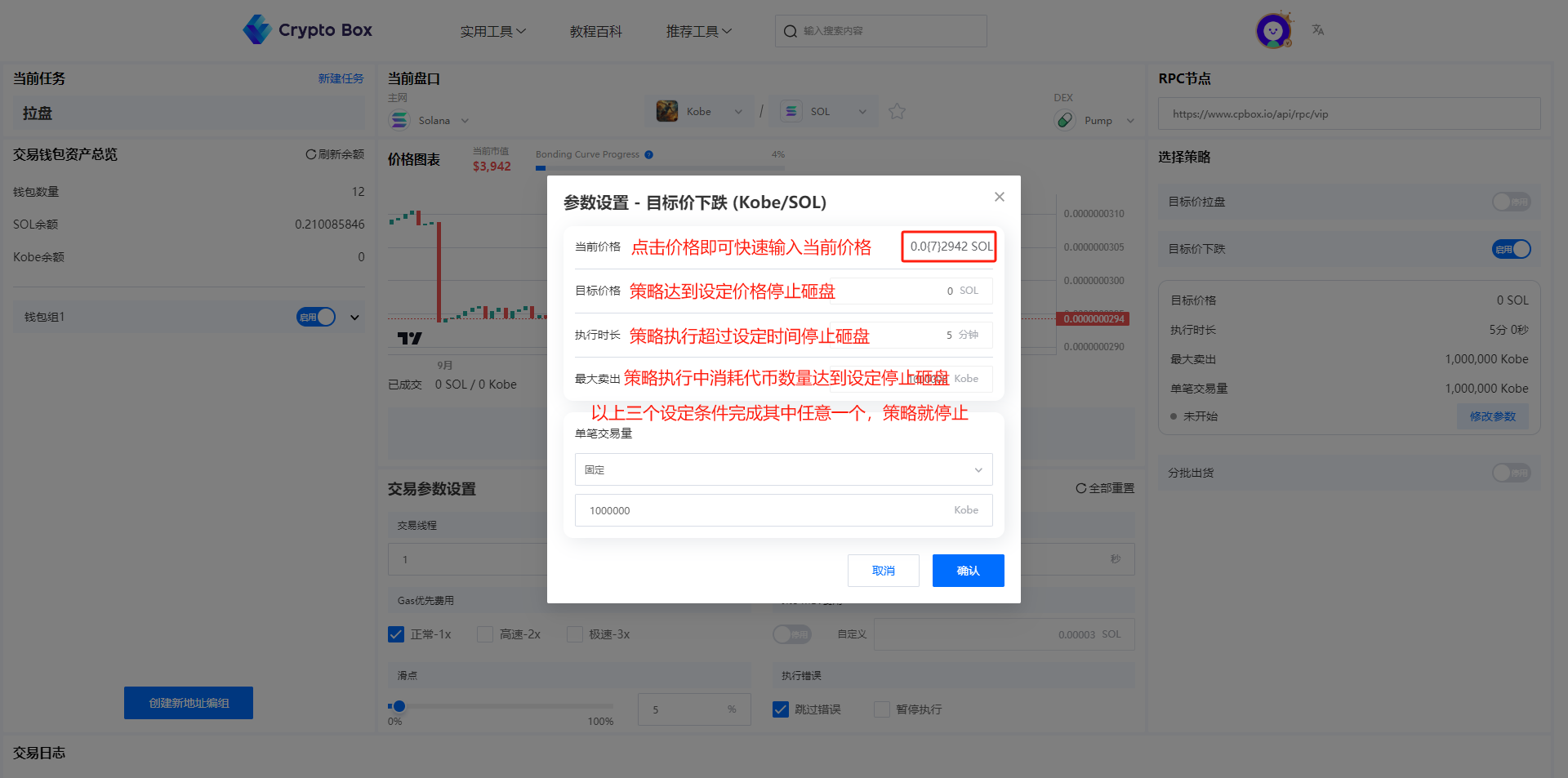

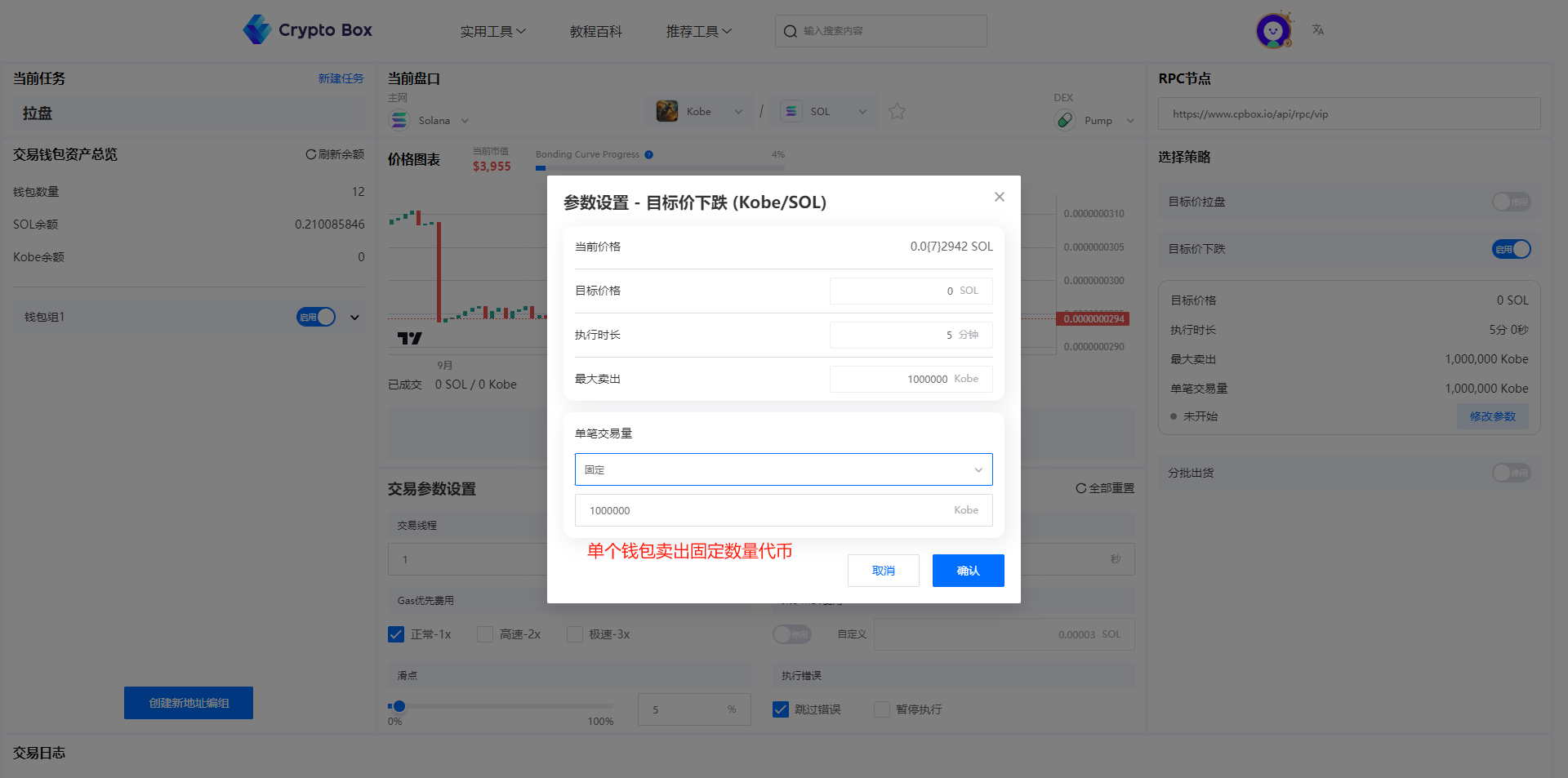

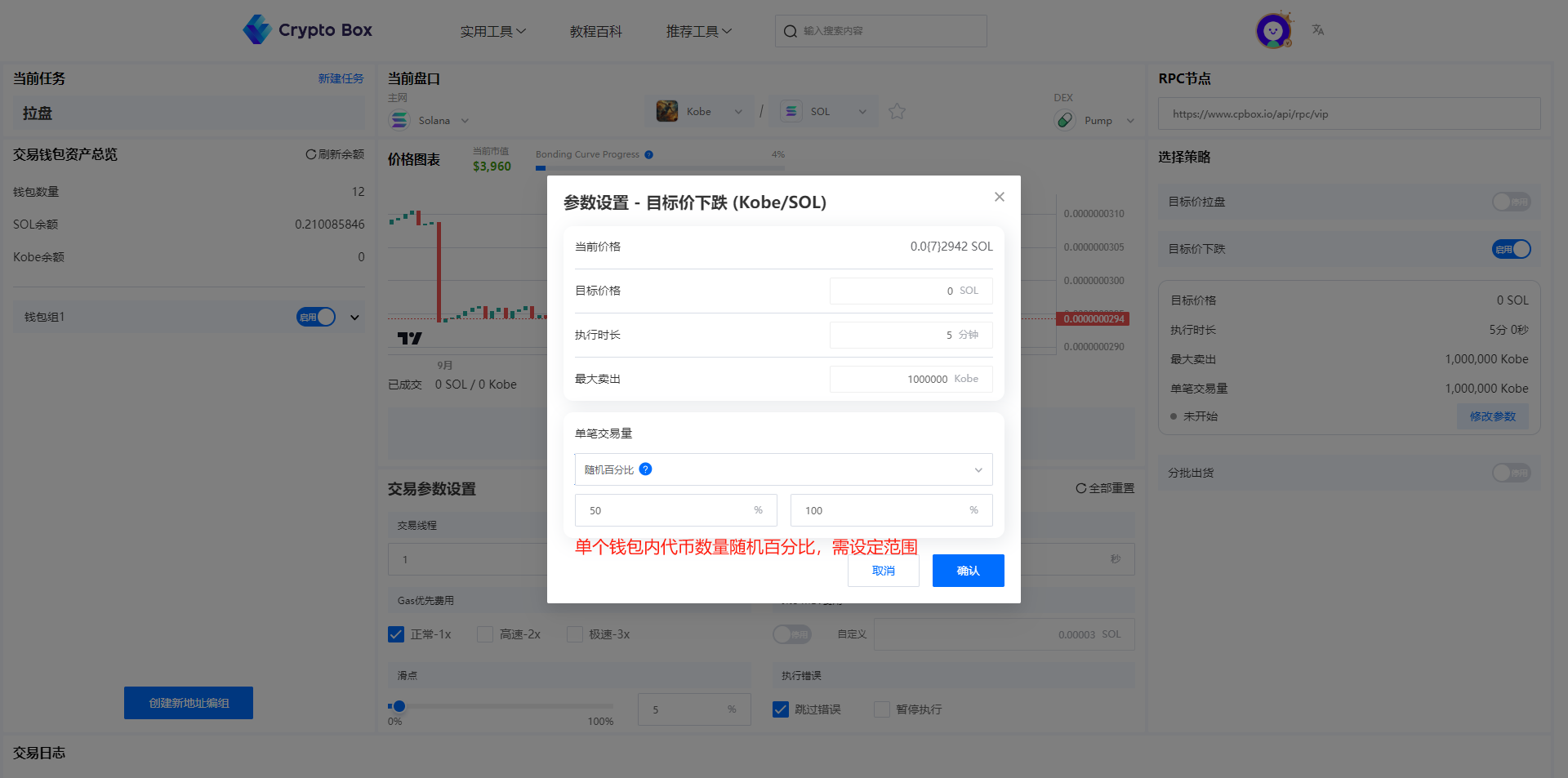

Target Price Drop Strategy

This strategy enables controlled price reduction to reach specific target levels.

Stop Price Configuration: The task automatically halts when the token reaches the predetermined SOL-denominated target price.

Price drop parameters

Sell Parameters (Per Wallet Configuration):

Fixed SOL Amount: Sell tokens equivalent to a fixed SOL value per wallet.

Random SOL Amount: Randomize SOL-equivalent sell amounts within specified ranges.

Fixed Percentage of Token Balance: Sell a predetermined percentage of each wallet's token holdings.

Fixed percentage of wallet balance

Random Percentage of Token Balance: Apply randomized percentages for more natural selling patterns.

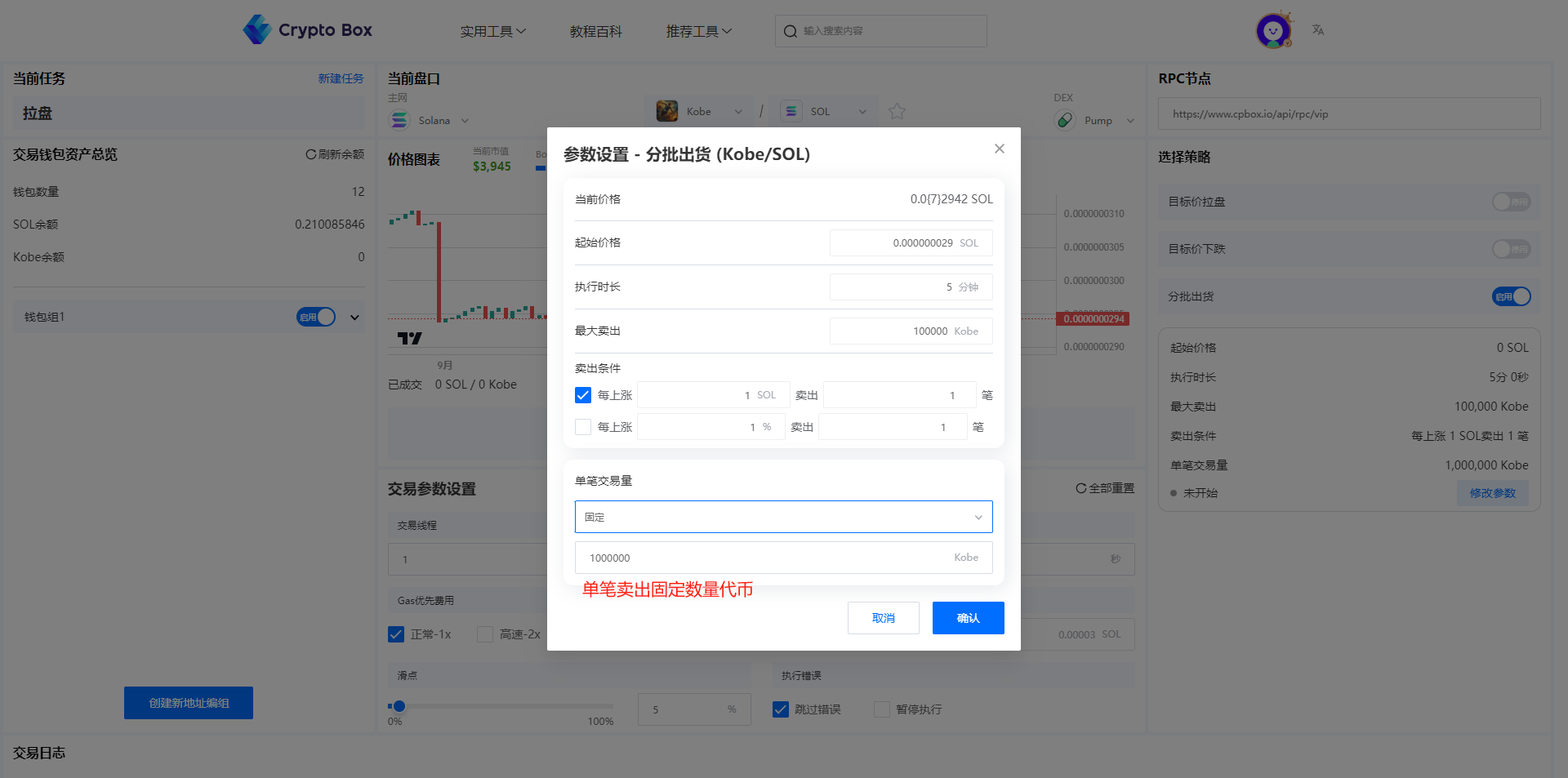

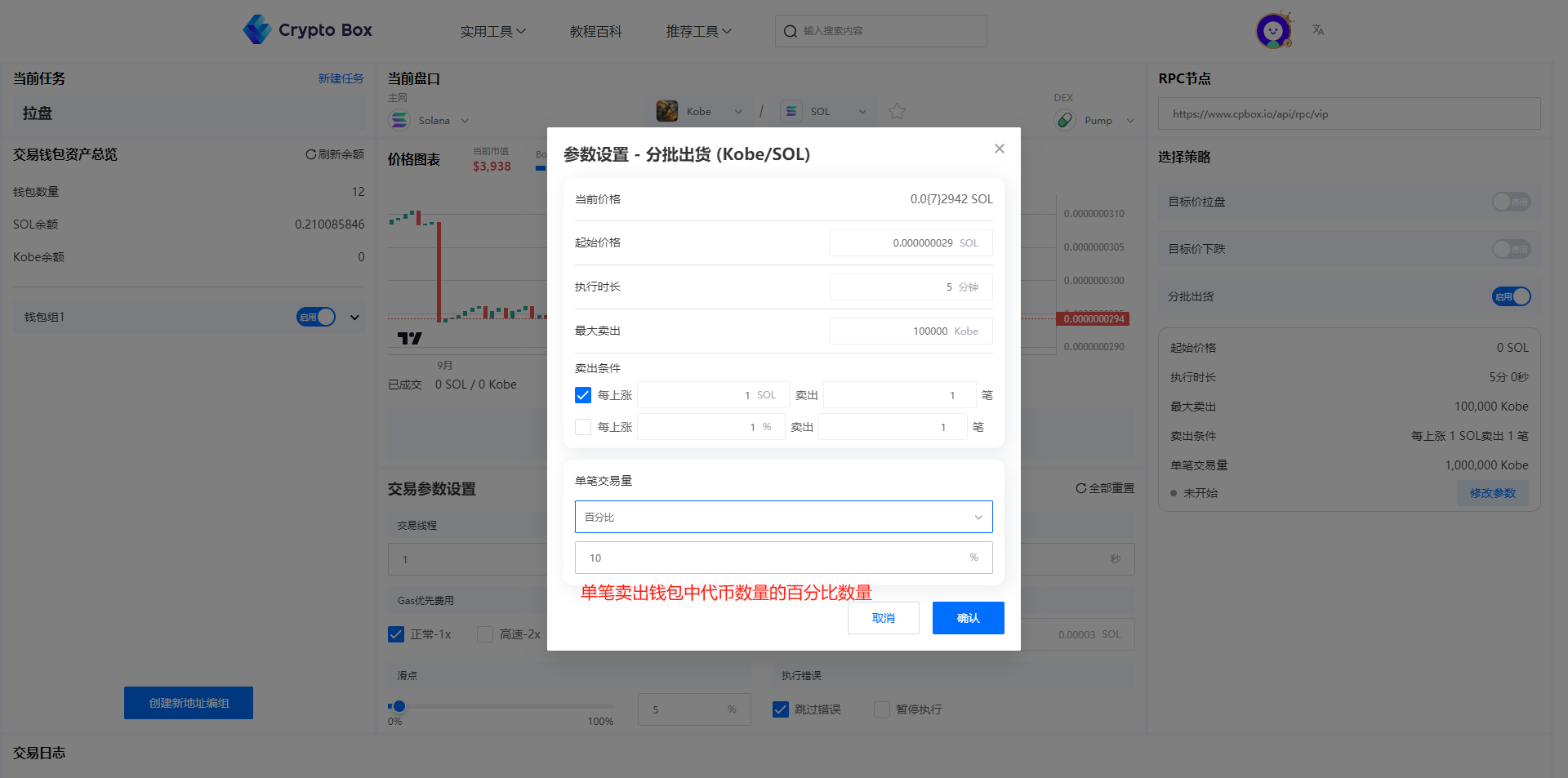

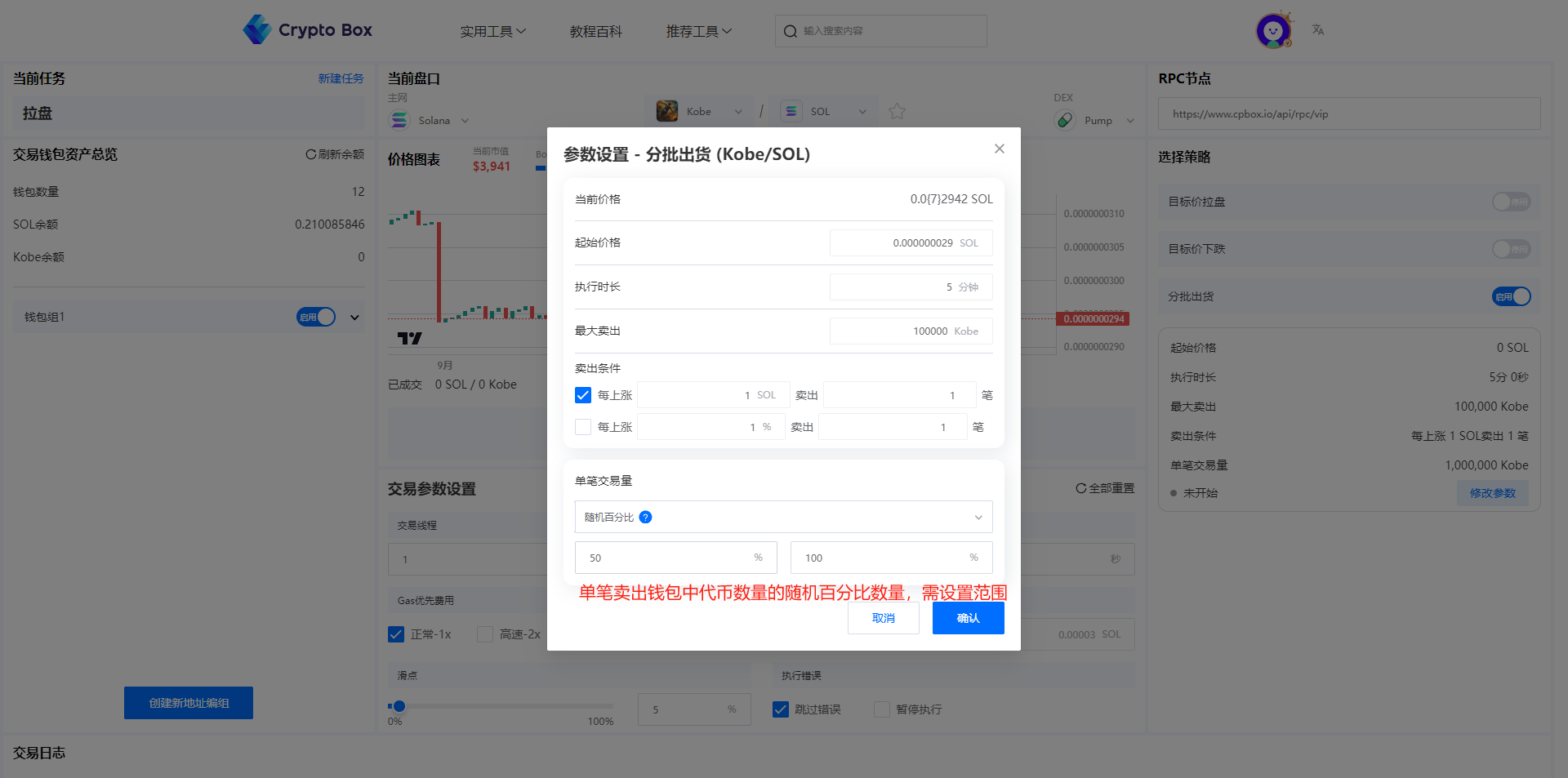

Batch Sell-Off Strategy

This strategy enables systematic token distribution across multiple wallets with customizable parameters.

Sell Conditions Configuration:

Fixed SOL Amount per Wallet: Each wallet sells tokens equivalent to a specified SOL amount.

Random SOL Amount per Wallet: Randomize SOL-equivalent amounts within defined parameters.

Fixed Percentage of Token Balance: Sell a consistent percentage of token holdings across all wallets.

Sell fixed percentage

Random Percentage of Token Balance: Apply varied percentages for natural distribution patterns.

Sell random percentage

Strategy Execution:

- Immediate Launch: Execute the strategy immediately upon configuration.

- Scheduled Execution: Set specific times for strategy activation.

- Important Note: The frontend interface must remain open during execution to ensure security and maintain control over operations.

Strategy execution interface

Post-Execution Monitoring:

- Monitor real-time strategy status and performance metrics.

- Access detailed transaction hashes and execution logs in the Transaction History section.

- Track success rates and optimize future strategy parameters.

Customized Professional Services

We understand that each project has unique market requirements and objectives. CPBox.io offers comprehensive tailored market cap management services specifically designed for Solana-based projects, including:

- DEX-Specific Strategic Solutions: Customized approaches for different decentralized exchanges.

- Event-Driven Short-Term Support: Targeted interventions for product launches, partnerships, and major announcements.

- Long-Term Token Appreciation Programs: Sustained growth strategies for continuous value enhancement.

- Risk Management Protocols: Advanced safeguards to protect against market volatility.

Professional Consultation: Our expert team provides 24/7 consultation services to deliver personalized solutions and competitive quotes. Let CPBox.io empower your project to excel in today's competitive digital asset markets.

Learn More About CPBOX

Explore comprehensive features and capabilities: https://docs.cpbox.io

Have suggestions or custom requirements?

Contact us: https://www.cpbox.io/

Join Our Community

Telegram Group: https://t.me/cpboxio

Twitter: https://twitter.com/Web3CryptoBox | https://x.com/cpboxio

YouTube: https://youtube.com/channel/UCDcg1zMH4CHTfuwUpGSU-wA